Upstart’s Credibility Gap

Summary: What Upstart Network is, the credibility gap that emerged from repeated revenue guide misses and putting loans on its balance sheet, what Upstart should do to fix this, and implications for investors.

Upstart is a technology company that builds machine learnings models for better lending outcomes. The company does not take direct credit risk, but instead partners with banks who want to increase their lending revenues while taking equal or less risk.

Upstart’s model is premised on the idea that the FICO score, which was invented in 1989, is increasingly obsolete. Upstart marries repayment data from Transunion with hundreds to thousands of additional data points from prospective borrowers to build proprietary machine learning models that deliver superior outcomes to lenders. The company kept its IPO video up after it went public, and it’s still a good place to start understanding Upstart.

These superior lending outcomes manifest themselves in either significantly lower loss rates given the same level of loan approvals (the figures range from 40-75 percent lower loss rates), or significantly higher rates of approvals for banks that want to keep losses constant (as high as 3x the approval rates).

Upstart was founded by a team of ex-Googlers led by Dave Girouard, who helped build Google’s cloud business and Anna Counselmen (also from Google), alongside Paul Gu, who dropped out of Yale after receiving a Thiel Fellowship.

Upstart’s business model is simple: the company acquires customers through online and offline channels, performs the underwriting on the spot, and creates a loan that is then funded and held by its bank partners. Upstart earns a 7 percent take rate on its current personal loans in the form of an upfront fee, which can be thought of as a customer acquisition cost for the lender.

Upstart plans to enter auto and small business lending this year, and mortgage lending in 2023-2024. These combined markets are quite large, on the order of $6 trillion. Take rates in auto will be similar to personal, but mortgage take rates will be lower.

The bull case for Upstart’s success is premised on its superior risk model, and the flywheel effect of having more data and scale than other players, which allows it to further improve its models.

If this is the case, Upstart could gain a dominant lead over lenders who don’t have similar scale. In activities such as playing Chess, Go, Texas Hold’em, and protein folding, machine learning has successfully outperformed humans.

It would stand to reason, then, that Upstart’s machine learning can also outperform a human armed with a FICO score.

Skeptics believe this is not possible. Lending is different from games with fixed rules such as Chess, Go and Texas Hold’em; there are unique factors that must be considered, such as interest rates, unemployment, recessions, and pandemics, to name a few.

Then there is fraud. How does Upstart prevent adversarial attacks, such as customers using VPNs to mask their location, or perhaps using multiple machines to take out multiple loans at the same time? It is plausible that Upstart’s models wouldn’t detect such activity in real time, and the problems wouldn’t come home to roost until many months later, exposing the buyers of the company’s loans to losses.

Skeptics assert that no amount of machine learning training can accommodate these edge cases.

Upstart’s team, however, is pressing forward. Their vision is to create the “Amazon of Lending,” where anyone can visit the company’s website and find whatever type of loan they want (personal, mortgage, auto, or business) and be matched in real time with a marketplace of lenders bidding for that particular risk. Customers know that Amazon will typically provide the best deal and have little incentive to compare prices; that is the future that Upstart is trying to build.

Co-founder David Girouard explains:

Upstart is now about the size that Google was at the time I joined that company in early 2004. So I’ve seen this movie before—and hope to use what I learned there to build Upstart into the most impactful FinTech in the world. I have some specific personal goals for Upstart in 2022. First, to transition into a multi-product, distributed company that can operate in parallel instead of in serial. Second, to break new ground in terms of quality of execution at the “billion dollar plus” scale, with leaders such as Google, Amazon, and Apple as my north star. And third, to move aggressively to unlock Upstart’s addressable market while simultaneously upgrading our ability to pursue it. These challenges will keep our leadership team busy in 2022 and well beyond.

Upstart is a unique company both in terms of our technology and our business model. We don’t exactly look like anybody else, and for this reason, we’re often misunderstood. So in closing I’d like to share a few thoughts about Upstart that have struck me in the last few months as useful ways to understand who we are and what we’re building.

First, Upstart is both a consumer internet brand as well as a cloud software provider, delivering a deeply proprietary and technical product to our bank and credit union partners. This combination is entirely unique, and is central to our competitive position today and in the future. Were it not for the AI models at the core of Upstart, we would have little unique value to offer our bank partners. And were it not for our consumer presence and scale, we would not control our destiny, and our AI models would not be learning as quickly as they are. This combination means we can dramatically strengthen the competitive position of banks that partner with us, while simultaneously helping consumers find the very best credit product available to them.

Upstart grew revenues 264 percent in 2021, to $849 million, and, in mid-February during the Q4 2021 earnings release, guided to growth of 65 percent in 2022 to $1.4 billion.

After the Q1 2022 earnings release, that guidance was lowered to $1.25 billion. Yesterday after the market close, Upstart once again lowered full-year guidance by announcing a Q2 shortfall:

Inflation and recession fears have driven interest rates up and put banks and capital markets on cautious footing,” said Dave Girouard, co-founder and CEO of Upstart. “Our revenue was negatively impacted by two factors approximately equally. First, our marketplace is funding constrained, largely driven by concerns about the macroeconomy among lenders and capital market participants. Second, in Q2, we took action to convert loans on our balance sheet into cash, which, given the quickly increasing rate environment, negatively impacted our revenue.

The implied full-year guidance now, at the midpoint, is $1.178 billion, or 39 percent year-over-year growth. The stock declined nearly 20 percent to $27.

Upstart’s Credibility Gap

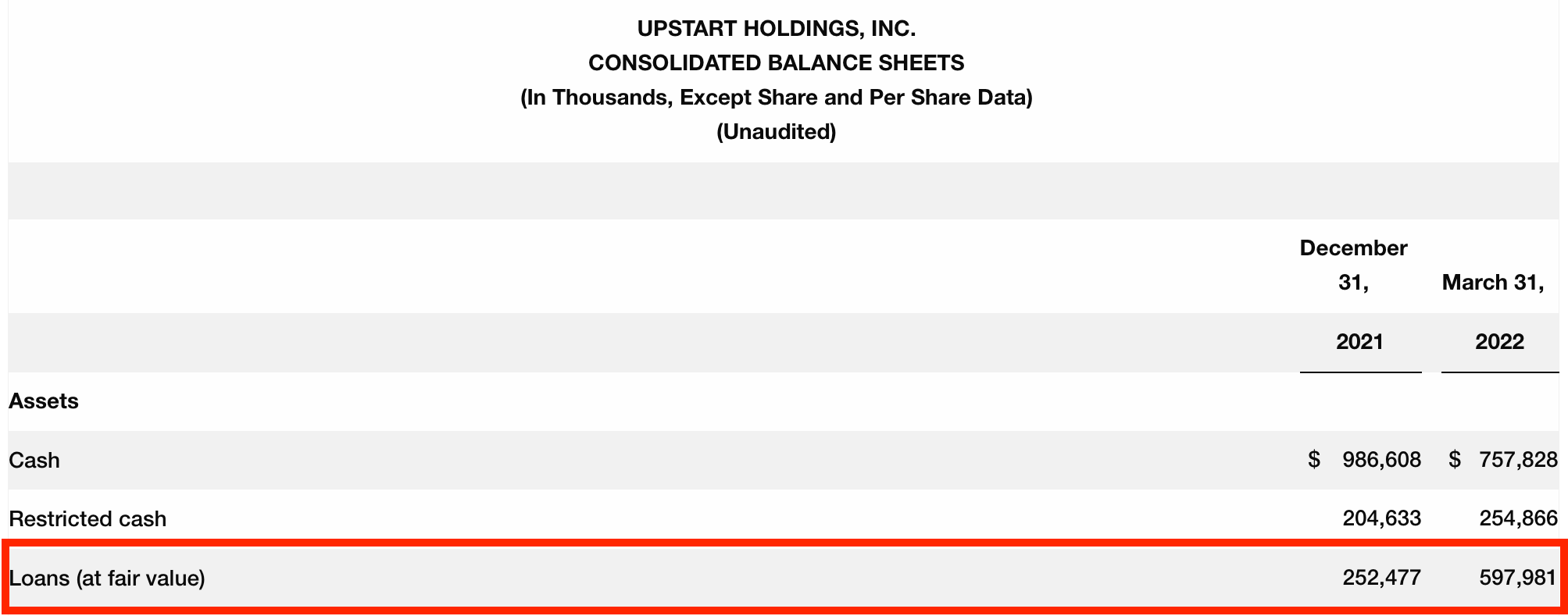

The original sin was deciding to put loans on Upstart’s balance sheet in Q1. The market immediately picked up on the sequential increase of $345 million in loans, up 137 percent in the quarter:

Sanjay Datta, Upstart’s CFO, explained the increase in his opening remarks of the earnings call on May 9th:

We've continued to deploy our balance sheet assertively in the service of R&D in both auto lending and new segments of personal lending as well as using it to smooth fluctuations in funding of corporate loans.

[…]

Additionally, we have started to selectively use our capital as a funding buffer for core personal loans in periods of interest rate fluctuation where the market clearing price is in flux. Our balance of loans, notes and residuals at the end of the quarter was consequently up to $604 million from $261 million in Q4.

Later, in response to a question, Datta elaborated:

So—and then your second question is how we plan to use our balance sheet. And as I said, I mean, historically, our balance sheet has been almost exclusively for the purpose of R&D. We have used our balance sheet in the last quarter to do what I call sort of a market-clearing mechanism. And by that, what I mean is when interest rates in the economy change quite quickly, I think it would be fair to say that our platform, its ability to react to the new market-clearing price, it's probably not as nimble as we would like. It's somewhat manual. It requires a bunch of conversations and phone calls.

And so when interest rates smooth and investors are -- so each deciding what their new return hurdles are, there can be a gap or a delay in responding to funding. And that's a situation where we've chosen to sort of step in with our balance sheet and almost sort of bridge to the new market-clearing price. And if that is happening often and abruptly, we've been sort of playing that role with our balance sheet.

That decision cost Upstart shareholders $3.6 billion in market value right off the bat. Certainly, some of the decline was also due to the lower revenue guidance, but the problem most analysts fixated on was the loans on the balance sheet. This exchange later in the call captured the feeling:

Simon Alistair Vaughan Clinch Atlantic Equities LLP, Research Division – Research Analyst

Okay. And just to follow-on on the last point. I'm kind of surprised to hear that you're using your balance sheet to put some loans on there, which aren't just for R&D purposes. And it strikes me as it's just not a normal course of business for you given you're a platform business. So I was just wondering what kind of message that might send to your bank partners or to others in the system. Just curious about that.

David J. Girouard Upstart Holdings, Inc. – Co-Founder, President, CEO & Chairperson of the Board

Look, I think it's—Sanjay kind of explained this. Generally, we view ourselves as a marketplace where ultimately, price discovery happens and loans are funded or not funded when they make sense by our bank partners or by capital markets, institutional investors, et cetera. Some of this works very fluidly, particularly on the bank and the credit union side, where they have very direct controls to change their return hurdles, et cetera. We don't have those mechanisms in place as well on the other side. It's more of a manual process.

So when something changes as quickly as it did in interest rates and the risk premiums in the market changed very rapidly, then we step in to sort of bridge that. But it's sort of a temporary thing. And as Sanjay said, it is an intention of ours to make the system more automated and more fluid so we don't have any need to do that. It's not part of our business to hold loans generate net interest income from loans in our balance sheet, but we certainly want to make sure there's fluidity in the system. And we're definitely going to do some more work so we can do that without any of our balance sheet participation in that.

Sanjay Datta Upstart Holdings, Inc. – CFO

And Simon, just to maybe put the numbers into context, but I think the amount of the total platform loans that ended up on our balance sheet this quarter was still a single-digit percentage. And of that amount, probably close to 3/4 of it is still—was still R&D-style spending on predominantly auto loans and other new products and segments. So it was still a relative minority or a relatively small percentage, but it is just sort of an important new thing that we haven't been doing in prior quarters just because of the fluidity of the environment.

Here is the problem: it doesn’t matter if “the total platform loans that ended up on our balance sheet this quarter was still a single-digit percentage” of the originated loans.

Investors will immediately assume the worst: the company is selling off the good loans and keeping the bad loans on its balance sheet, or perhaps demand for its loans is drying up, and the company had to step up to make its quarterly guidance.

Furthermore, if Upstart wants to be a financial tool like FICO, it must deliver FICO-like financials. FICO—Fair Iaac Corp—is publicly traded. The company has 78 percent gross margins, generates 20-30 percent free cash flow margins, and has historically traded at a multiple of 20-30x free cash flow.

The moment Upstart puts loans on its balance sheet, it becomes a subprime lender. Those companies—we can look at Synchrony Financial or Lending—tend to trade at earnings multiples below 10x.

That is a big difference. The market is in effect saying, “You are now a subprime lender using its own balance sheet, and you’ll be valued as such.”

Furthermore, if there is one thing that investors have learned over and over again, is that “fast-growing” and “financial company” don’t go together. History is littered with the carcasses of banks, subprime lenders and insurance companies, to name a few, that have grown fast and flamed out even faster.

It is not surprising, therefore, that a whopping 36 percent of Upstart’s shares are currently sold short. Investors are betting on more declines.

The day after the May earnings call, Jim Cramer interviewed Upstart co-founder Dave Girouard on Mad Money, and went straight to the point:

CNBC pundit Jim Cramer interviewed Upstart’s Chief Executive Officer (CEO) Dave Girouard following the earnings fiasco. Cramer summed up why the stock has collapsed: “Why do you have any loans on your balance sheet? I thought you were a platform […] I did not know Upstart, I thought I did […] I was shocked at the bad loans, potentially bad loans, on your balance sheet.” Upstart’s CEO responded that it was holding loans on its balance sheet to test new products and loan models and that it still isn’t a large portion of their overall business.

However, Cramer cast doubt on this justification, saying: “It was certainly ill-advised to have that many loans on your balance sheet. And a lot of the bankers tell me it was because you couldn’t get rid of them.” If that last part is true, it could suggest that Upstart is facing systemic risks going forward. The whole business model is built on selling loans to banks. If the banks stop buying, the company will be in trouble. Throw in rising interest rates and surging inflation, and Upstart’s lending model is about to be tested dramatically. Until investors can regain confidence in Upstart’s business strategy and capital allocation choices, UPST stock is an exceptionally difficult investment.

Jim Cramer isn’t always right, but in this case, he is spot-on: if you are a lender, it’s OK to put loans on your balance sheet. If you’re a marketplace, like Upstart aspires to be, it’s certainly not OK.

The good news is that Upstart seems to have learned its lesson. Datta, a month later, elaborated:

Well, I'll be honest with you, in Q1, I think we had an idea. It was probably a good use of our balance sheet because it's just a random cross-section of the loans that are being priced at the newer market rate. We weren't using it to somehow underprice loans or anything like that. We were once again in a situation where the equilibrium equation on the platform is that we had more borrowers than funding dollars even at the sort of new market rates. And we thought it would be a good use of our balance sheet to sort of absorb some of that excess forward demand. And then you can always traffic it through secondary markets or whatever.

So I think we had that maybe point of view in Q1. Obviously, the market reacted very unhappily to that. And so it's not something I've ever carried strongly enough to sort of hold out on. I think the market really wants to view us as a marketplace that reacts to the vagaries of the market and accepts volume volatility as a result, which is how we largely view ourselves, then I think that the takeaway for us is that we'll just keep our balance sheet out of it. And we'll really sort of reserve it for the pure purpose of R&D, which is sort of the core reason we've raised the money.

This solves the loans-on-the-balance sheet problem. But Upstart has more.

Upstart’s Funding Problem

Upstart’s ability to grow depends on a balance between borrower demand—how many people want to borrow money, and at what interest rates—and lender supply—how many lenders are willing to lend money, at what loss rates and at what coupons.

For example, if the loss rate is 7 percent and the investor wants a 7 percent return, the coupon on the loan must be 14 percent.

In low interest rate environments, those variables don’t change much. But in environments of rapidly rising rates, investors demand a higher return. Loss rates might also go up, because the economy might be slowing. Both of those things are happening right now: the loss rate might be 10 percent, and the investor might demand 10 percent, so the coupon might be 20 percent.

At the same time, there are more borrowers wanting loans, because of the slowing economy, and fewerlenders, because they’re worried losses and rates might go even higher.

Upstart gets a take rate on loans. For personal loans, it’s about a 7 percent take rate. Whether a loan performs well or not, or whether losses are high or low does not impact the take rate.

Of course, if Upstart’s loans were to consistently perform poorly, the company’s business would disappear, and it wouldn’t be able to charge any take rate at all. But as long as its models prove their superiority, the company has “pricing power,” so to speak.

Datta explained the history of this supply/demand dynamic:

Over the last couple of years, yes, I mean, I guess, in sort of normal pre-pandemic times, throughout our history, the majority of the time -- so we're an ecosystem that brings together prospective borrowers and lending capital, either from banks or from institutional markets. Almost the entirety of our history, we've been borrower constrained. So there's been funding availability at some sort of market rate, and our growth model has been about finding more borrowers and converting them economically. So it's the classic sort of consumer growth marketing hacking kind of activity.

There's now been three occasions in our history where that equation is reversed and we've been funding constrained. The first one was back in 2016 when we were still somewhat early as an industry and a bunch of things happened that I won't belabor. The second time was basically in March of 2020 when the pandemic first hit and everybody was extremely nervous about the direction of unemployment and the economy. That pretty quickly reversed in mid-2020 for us and mainly to do with the stimulus that was injected in the economy.

And so if you think about the equation, it's the balance of borrowers and funding. I think historically, it's been borrower constrained. Funding availability essentially went to zero for a couple of months post pandemic. It then very quickly reverted. And what happened was the funding availability became tremendous, and it's because there was an extra $5 trillion of stimulus in the economy. And the borrower demand itself was very suppressed, and it's because there is very little credit card debt to refi and everybody had pretty flush balance sheets and personal savings accounts. So I'd say for the past 12 to 18 months, there has been a significant excess capital and a real dearth of borrower demand.

And that has once again been flipped on its head. And so we're now in a world where demand on the borrower side is going up pretty significantly. I think a lot of the stimulus has now been flushed out of the economy or even spent to where it's been put in the equity markets and thus disappeared. And their credit card balances are going up. Their expenses are going up with inflation. And so demand for credit on the borrower side has gone up. And of course, the funding availability has gotten quite skittish just with the uncertainty around inflation and the potential for recession and war, et cetera.

So we're once again, for the third time in our history, in a world where we are funding constrained versus borrower constrained.

Datta also elaborated on the take rate:

Our business model doesn't really have any yield in it. It has a take rate. So the way our business model works is we transact the loan, the borrower gets funded by the funding source and we just take a transaction. It's not in any way related to the sort of upside or the downside of the credit. When those loans are being sold at $1.08 into the ABS markets, we didn't get any of that. And so we just take a transaction. It's a take rate. It's a take rate we charge to the banks in order to transact the loans. So they're our customer in the business model.

And then the question is, well, does any of this impact that. And the answer is not in any exogenous way. We can charge whatever price we want and the banks can choose to sort of pay that or not. Ultimately, they pass it on to the consumer. So it's a question of whether the APR will work for the consumer or not.

But I will say that, in a more specific sense, our take rates are generally under-optimized to our P&L, meaning they tend to be, even in good times, just abstract away from the current environment. It was the case historically that we could have raised our take rates. It would have lowered origination volumes because banks would have passed that on to borrowers. But it would have increased our revenue and our profitability in calendar P&L. And the reason we had under-optimized take rates is because there is a value to us of the origination volume even at lower revenue because it accelerates the learning of the models. So more volume flowing through the models makes the models learn faster. And in addition, there's also a lifetime value to that loan, which is there is some probability that we'll take a second loan two years from now.

Do Upstart’s AI Models Work?

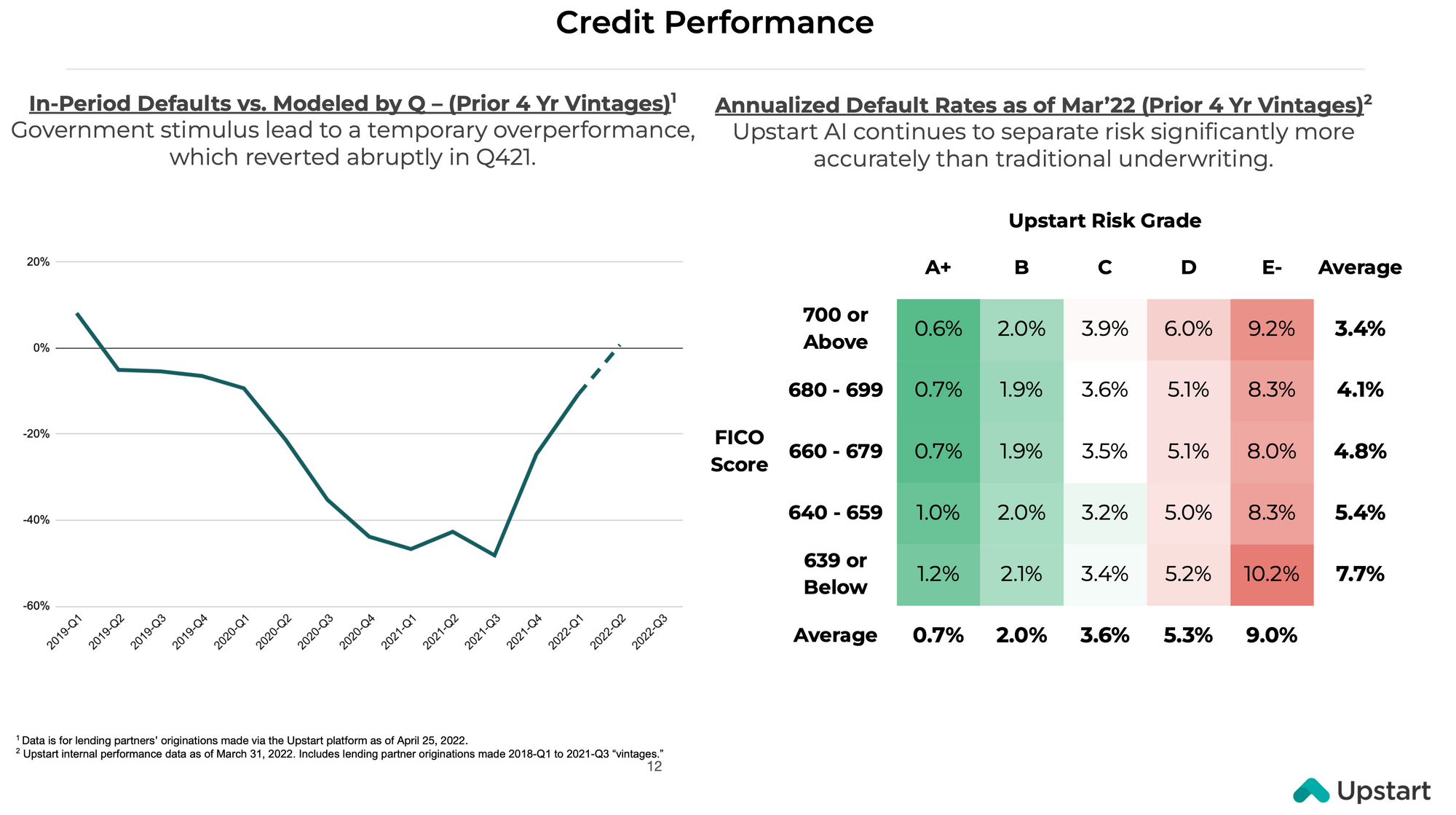

In the company’s May earnings call, Upstart presented a new slide in its deck:

The panel on the left shows how their securitizations outperformed at first (negative number means lower losses than expected). Recently, delinquencies had increased.

The panel on the right shows the risk stratification by FICO score, and how Upstart’s models are better than FICO.

To interpret this, look at how a very high FICO score customer might have a very low default rate (A+ on the Upstart risk metric) or very high default rate (score E-).

Similarly, a customer with a low FICO score might actually be a great credit, with a default rate of only 1.2 percent if it’s rated A+ by Upstart. This compares favorably with the 3.4 percent average default rate of the highest-tier FICO score customer.

Upstart’s model claims, therefore, to “see” more nuance than FICO and broaden the funnel of borrowers it can accept at similar loss ratios.

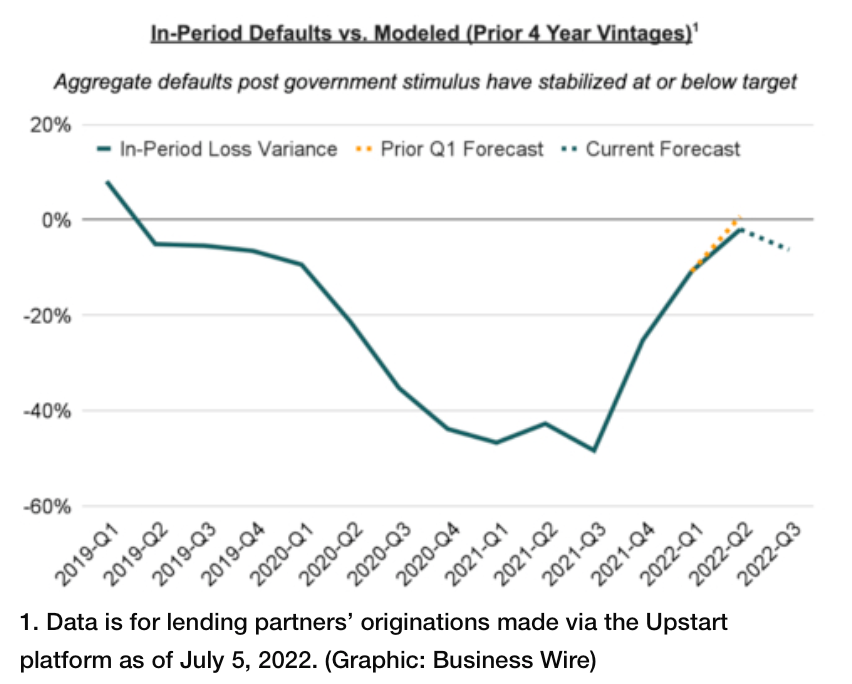

In yesterday’s announcement, the company updated the left panel (above) and noted:

For loans facilitated through our platform and held by our more than 60 bank and credit union partners, average returns have consistently met or exceeded expectations since the program’s inception in 2018.

For loans purchased by non-bank institutions, all vintages from 2018 thorough 2020 delivered significant excess returns, while our 2021 vintage is within 100 basis points of our loss expectations. Lastly, we believe our models are well calibrated to economic conditions and are currently targeting returns in excess of 10 percent.

This sounds pretty good. It might not assuage the concerns of the skeptics. “Maybe,” they might say, “this risk stratification is just a gimmick, and once we go through a full cycle, Upstart’s loans won’t perform any better than FICO.”

That’s possible. But it’s also possible that Upstart’s models are indeed superior. So far, it seems Upstart’s argument is winning.

Better Investor Relations

All of these explanations by Datta and the update in the press release are well and good, but they are one-off. Investor must wade through numerous disclosures and put the pieces together.

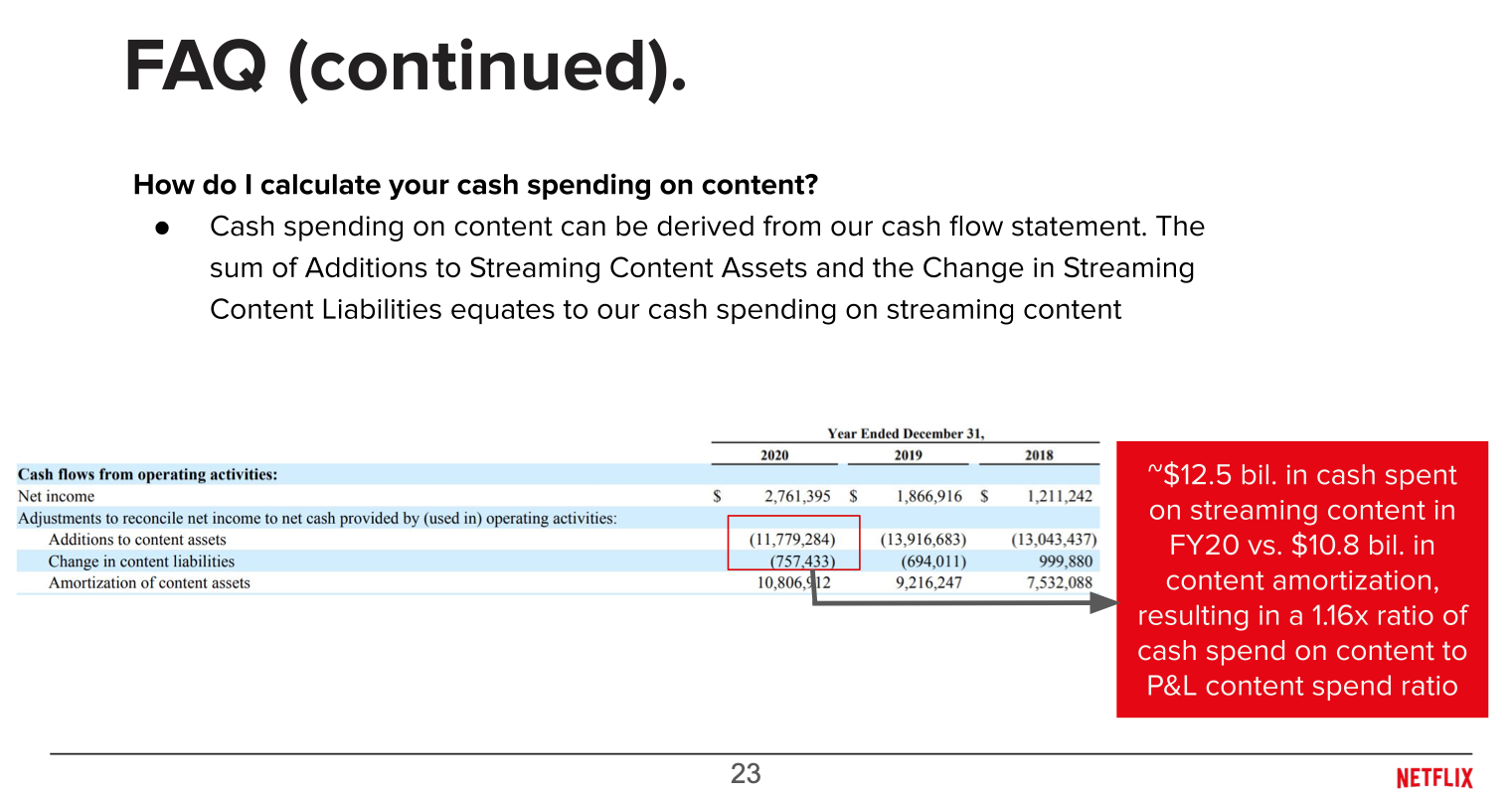

When companies are difficult to understand, they need better investor relations disclosures. This is something that companies like Netflix long ago understood.

On its website, Netflix has long had various sections dedicated to the nuances of its business, including an explanation of its long-term view, top investor questions and how the company’s accounting works.

Upstart should, at the very least, do something similar, and provide investors with a real time view of how its securitizations are performing. Currently, this information is buried in Kroll reports.

Every once in a while, a sell-side analyst will take a look at the Kroll reports, note that delinquencies are rising, and put out a note that only clients of that analyst can read. The stock will immediately sell off by 15 percent or so. Upstart, for its part, asserts that the Kroll data is meaningless because it does not include the target loss rates. Yes, loss rates might be rising, but they might still be below the target.

Given this complexity, why not make it easy for shareholders to understand where delinquencies stand compared to the target, on a weekly-updated part of the Investor Relations website?

Given the multi-billion dollar swings in Upstart market value, this would arguably result in a huge ROI on the extra effort.

Upstart employs a bunch of smart engineers. Here’s a recipe for better disclosures:

- Ingest delinquency data from the Kroll reports or other internal data

- Pair it with target loss data for those vintages

- Generate a chart with the loss trends and the targets

- Push the chart to the website

- Automate the whole process with a script that performs this on a weekly basis

Implications for Investors

Upstart has a long road ahead to rebuild credibility with investors and analysts. There were serial mistakes so far this year: two downward revenue guides, implying a vulnerability to volatile markets and an inability to correctly forecast the business or set expectations, and putting loans on the balance sheet, a major faux pas. And we’re just past the half-year mark.

But let’s suspend our judgment for a moment and pretend that Upstart can rebuild its credibility. What could this business be worth?

In 2021, Upstart generated $849 million of revenue and a net profit margin of 16 percent. On 96.2 million diluted shares, that’s earnings per share (EPS) of $1.41. On the current share price of $26.76, that’s a 19x earnings multiple.

But Upstart is growing briskly. If the current revenue guidance holds—a big if—the company would earn $1.96 this year, for a P/E of 14x.

This won’t happen, not because the company might guide revenue down again, but rather because the company is in growth mode and won’t reach the same net profit margin as last year. Datta has noted, however, that over time there’s no reason the company won’t get back to its previous profit margin.

Part of the growth stems from making a push into other types of loans. Its auto lending product is ramping up quickly. From the Q1 call in May:

One of our most important initiatives for 2022 is the accelerated rollout of our auto retail product. Since acquiring Prodigy in April of 2021, we expanded our dealership footprint from about 100 rooftops at the time of the acquisition to more than 500 today, making Upstart one of the fastest-growing auto retail software in the industry. Upstart's active dealership footprint over the last 90 days spans 35 different OEMs, including Toyota, Subaru and VW. At this point, we're also well into Phase 2, which is the introduction of Upstart-powered loans into our auto retail software. This represents the next critical good step in modernizing the car buying experience.

Without question, our early progress in delivering loans through our retail software has exceeded our most optimistic expectations. While lending has enabled in just a handful of dealerships in California, the uptake and win rate for the loan product, technically termed a retail installment contract, has been far better than anticipated. Our auto teams are working quickly to smooth some of the product edges, filling in a few missing features and completing integrations with various legacy dealer systems, all in the interest of moving toward a broad-based rollout. Our goal has enabled lending in a few dozen dealerships in 4 states this quarter, representing about 25% of the U.S. population, followed by a full nationwide rollout in Q3.

Based on what we now know, we expect the auto retail lending business to contribute meaningfully to Upstart's monthly transaction volumes by the end of the year, setting us up for a significant ramp in 2023. As I've said before, auto retail is perhaps the largest of all buy now, pay later markets. So this is one of the most exciting developments in Upstart's history. You should feel confident that we have a lot of executive attention on getting it right.

Can investors assume Upstart is "getting it right," given all the recent missteps?

If Upstart can indeed deliver on the promise of improved risk profiling in personal loans, auto loans and beyond, the growth rate should continue to exceed the low expectations baked into the current valuation.

This sets Upstart up for upside—but only if it can bridge that credibility gap.

Otherwise, look out below.