Chasing Tesla: There is No Catalog

In chapter five of their book The Innovator’s Solution, Clayton Christensen and Michael Raynor wrote that managers must ask, “What do we need to master today, and what will we need to master in the future, in order to excel on the trajectory of improvement that customers will define as important?”

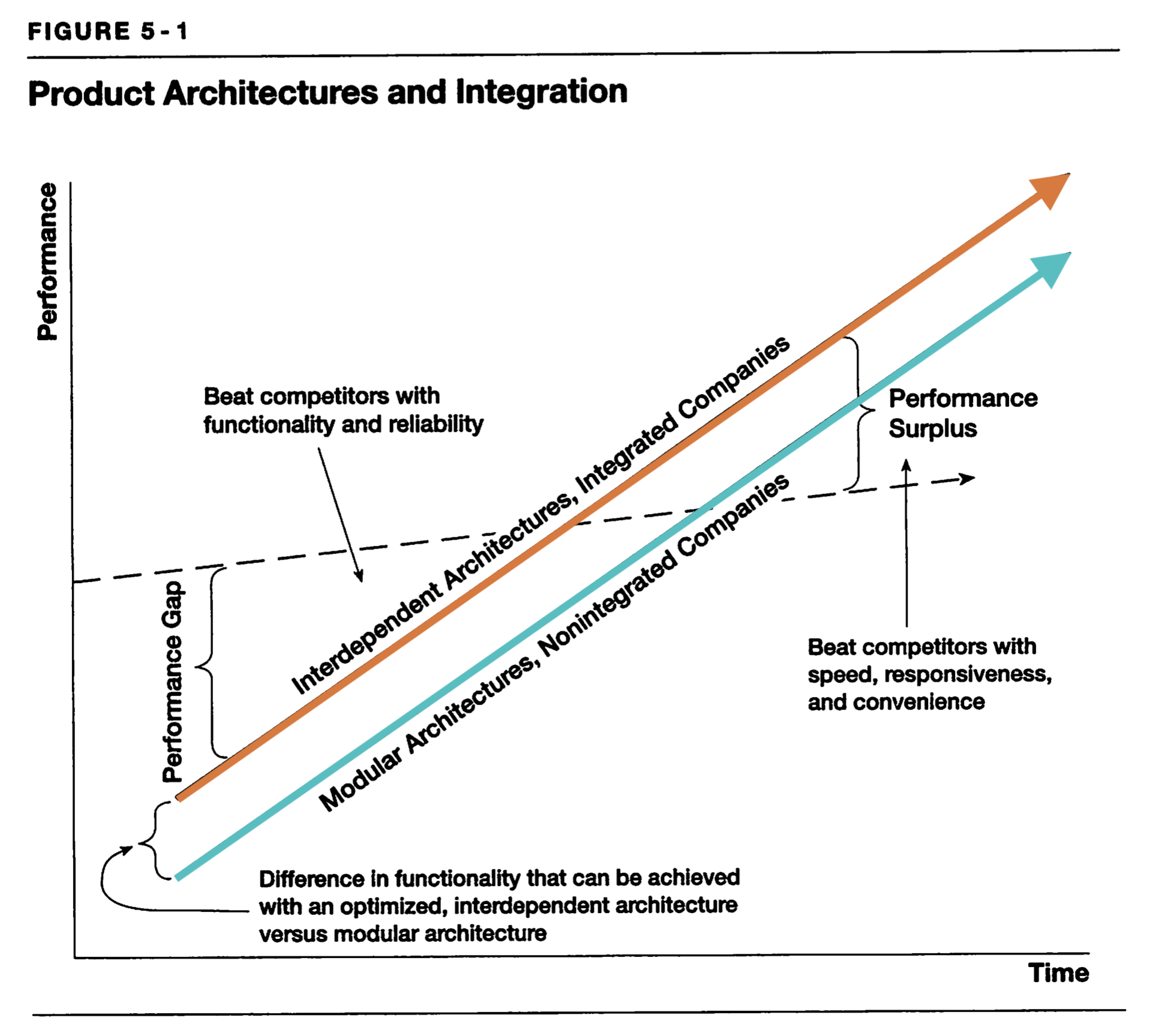

The “trajectory of improvement that customers will define as important” is the dashed line in the chart below:

The trajectory of integrated companies is shown in orange, superior to the trajectory of modular companies in blue, by virtue of the benefits that accrue to a business that pursues a strategy of vertical integration.

Christensen and Raynor use the example of IBM as a cautionary tale against outsourcing activities that “might seem to be a noncore activity today” but that “might become an absolutely critical competence to have mastered in a proprietary way in the future”:

Consider, for example, IBM’s decision to outsource the microprocessor for its PC business to Intel, and its operating system to Microsoft. IBM made these decisions in the early 1980s in order to focus on what it did best—designing, assembling, and marketing computer systems.

Given its history, these choices made perfect sense. Component suppliers to IBM historically had lived a miserable, profit-free existence, and the business press widely praised IBM’s decision to out-source these components of its PC. It dramatically reduced the cost and time required for development and launch.

And yet in the process of outsourcing what it did not perceive to be core to the new business, IBM put into business the two companies that subsequently captured most of the profit in the industry. How could IBM have known in advance that such a sensible decision would prove so costly?

More broadly, how can any executive who is launching a new-growth business, as IBM was doing with its PC division in the early 1980s, know which value-added activities are those in which future competence needs to be mastered and kept inside?

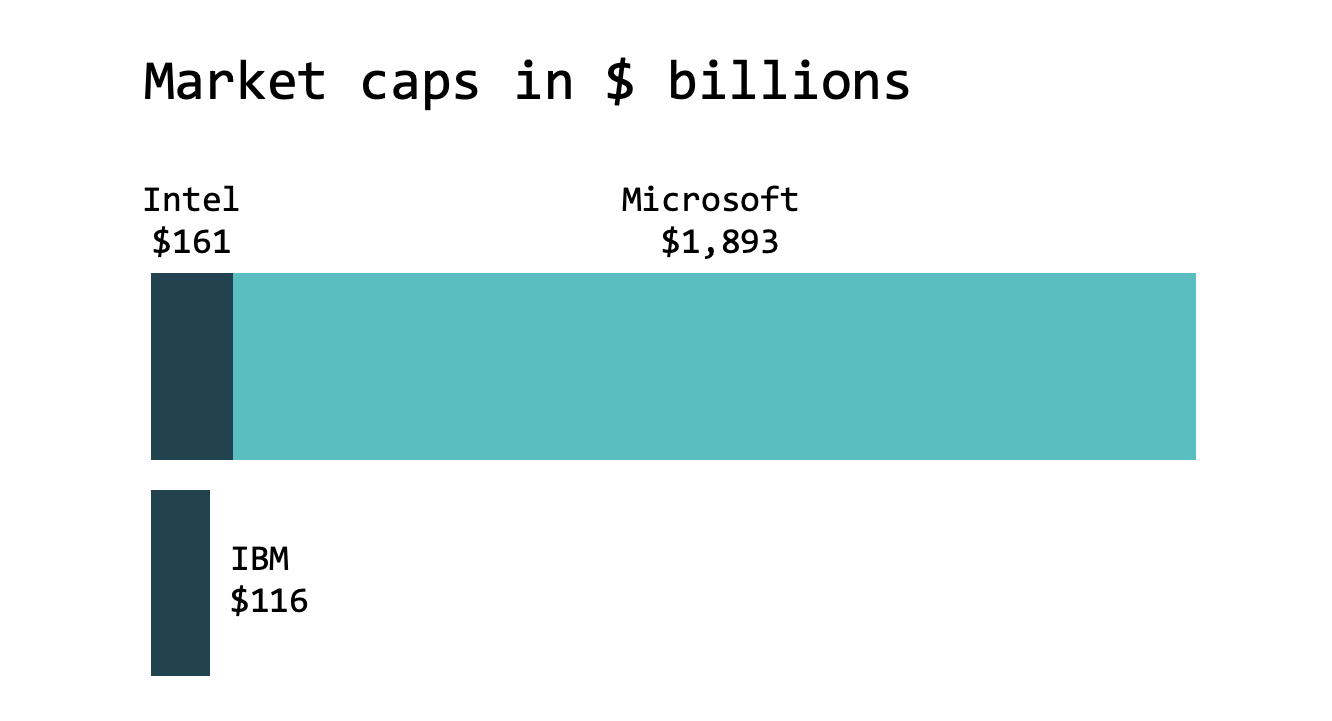

IBM’s decision to outsource chips and operating systems to Intel and Microsoft has resulted, many decades later, into it being dwarfed by those rivals in market value:

This chart is incomplete, of course, because it doesn’t include Intel’s own struggles with adapting to a changing landscape of integration and modularity; Intel itself is dwarfed by TSMC, which is valued at $438 billion currently.

Christensen and Raynor contend that in early markets—in our example, the electric vehicle or EV market—the “product functionality and reliability are not yet good enough to address the needs of customers” and therefore companies must employ proprietary, vertical integration, since using modular components “takes too many degrees of design freedom away from engineers, and they cannot optimize performance.”

We are witnessing this struggle between integration and modularity play out in the auto industry. Like IBM in the early 80s, traditional OEMs such as Volkswagen, GM, and Ford are good at “designing, assembling, and marketing” and perform very few functions in-house.

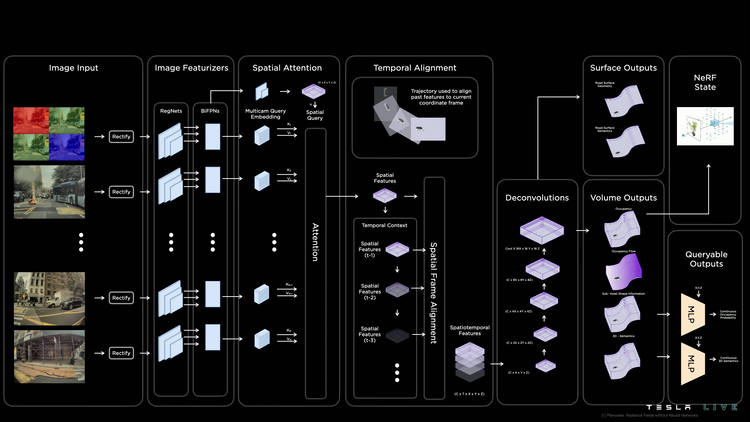

The shift to electrification and autonomy, however, shifts the basis of competition. Many suppliers and components simply do not exist. In its Q3 2020 earnings call, Elon Musk called the modular approach of incumbents “catalog engineering.” The industry evolved towards catalog engineering over one hundred years of innovation and consolidation. But in the new basis of competition, there is no catalog:

Tesla is absolutely vertically integrated compared to other auto companies or basically most any company. We have a massive amount of internal manufacturing technology that we built ourselves.

[…]

This makes it quite difficult to copy Tesla, which we're not actually all that opposed to people copying us, but it's quite difficult because you can't do catalog engineering. You can't just I'll pick up the supplier catalog, I'll get one of those machines, one of that machine, bingo, I'm now Tesla.

You have to—there is no catalog. What catalog—so we made the machine that made the machine that made the machine.

[…]

But yes, it's like we're just making a crazy amount of machinery internally. This is—Tesla is not well understood. If you just walk around the factory, you'd just get a sense for it. And—yes. I don't know if this is like a smart move. But I just know like, hey, if we're trying to make progress and nobody's got the machines that we need, we've got to make it, so we do.

The dearth of adequate suppliers has forced Tesla into vertically integrating various aspects of its business:

- It builds its own factories with an internal team, seeking to optimize floor layouts, continuous motion production, the amount of factory volume devoted to manufacturing, ultimately lowering the cost per vehicle and per battery cell

- It has its own custom silicon for autonomous driving machine learning

- It has created its own proprietary lithium cell form factor and manufacturing process

- It sells direct to consumer, eschewing the additional layer (and lost profits) of the dealership franchise model

- It does advertising internally, through Elon Musk; that is, there are no outside ad agencies, and Tesla doesn’t advertise, because it doesn’t need to

- It recently launched Tesla insurance, which is already the second largest insurer of Teslas in the state of Texas, saving customers money and making them safer through real-time behavioral feedback

Tesla even built its own ERP system, ditching SAP as far back as 2013. SAP—a German company—counts Volkswagen as a customer. In 2019, VW said it was investing heavily in its relationship with SAP. For Tesla, SAP did not work:

Tesla Motors has proven that it can build the most modern cars in the world. And apparently Elon Musk insisted they build their own IT systems and e-commerce platform, too.

Most all of Tesla’s IT is homegrown, said CIO Jay Vijayan […]. The reason: the traditional enterprise resource planning (ERP) systems did not cut it, and the company has a vertically integrated operation that required a custom environment.

The speed and agility Tesla needed in an ERP environment could not be found in the market, Vijayan said. SAP’s ERP tech was clearly not working for other car manufacturers and Vijayan knew what it would take to implement and update the SAP environment. “Elon said this is not going to cut it,” Vijayan said.

In four months, Vijayan and his team of more than 250 built the ERP system, which serves as the foundation of the electric carmaker’s operations. Now every department is using the same system without the need for making custom connectors, so different systems can work together.

Modularity Eventually Wins... Right?

Christensen and Raynor, however, explained that modularity eventually wins:

Modularity has a profound impact on industry structure because it enables independent, nonintegrated organizations to sell, buy, and assemble components and subsystems. Whereas in the interdependent world you had to make all of the key elements of the system in order to make any of them, in a modular world you can prosper by outsourcing or by supplying just one element. Ultimately, the specifications for modular interfaces will coalesce as industry standards. When that happens, companies can mix and match components from best-of-breed suppliers in order to respond conveniently to the specific needs of individual customers.

In fact, Figure 5-1, above, is intended to show the modular competitor (blue line) eventually disrupting the integrated player (orange line) because it crosses customers’ expectations (dashed line). At that point, the solution becomes “good enough.”

Ben Thompson, however, has shown that this model is incorrect. The reason is that Christensen and Raynor rely on businesses making purchasing decisions, not customers. When it comes to customers, “good enough” doesn’t exist; they are, in the words of Jeff Bezos, “divinely discontent.” The dashed line can therefore never be crossed, and the orange line—the integrated player—will remain perpetually ahead of the modular player.

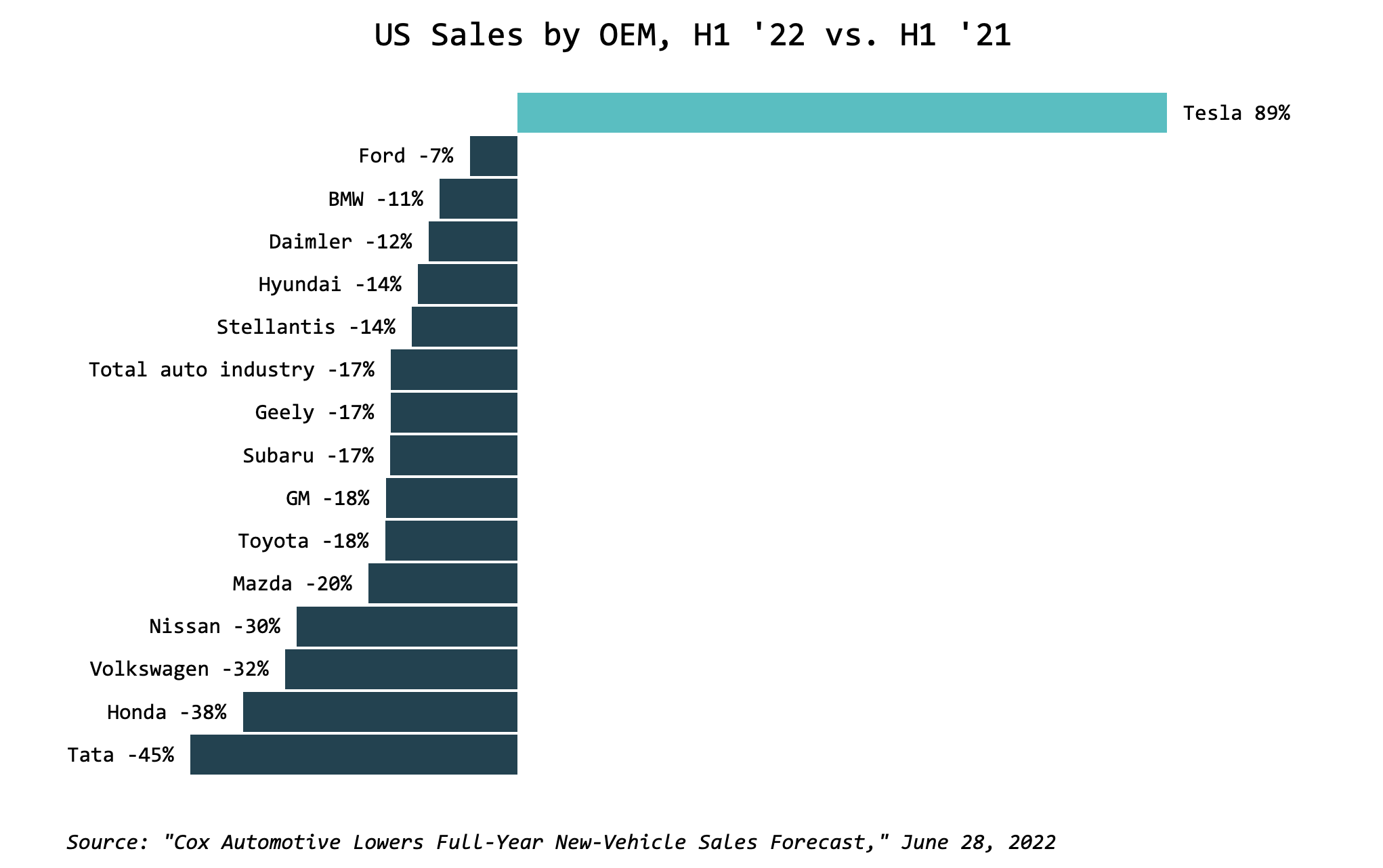

Incumbent automakers are not standing still. They are now attempting the quantum leap from blue to orange line by increasingly vertically integrating their operations. So far, it is not working out. Internal combustion engine (ICE) vehicle sales continue to melt down. A lot of the sales declines shown below stem from supply chain issues, but ICE volumes have declined consistently for years now:

Meanwhile, incumbents’ EV sales are still minimal, although they are spending furiously to catch up with Tesla.

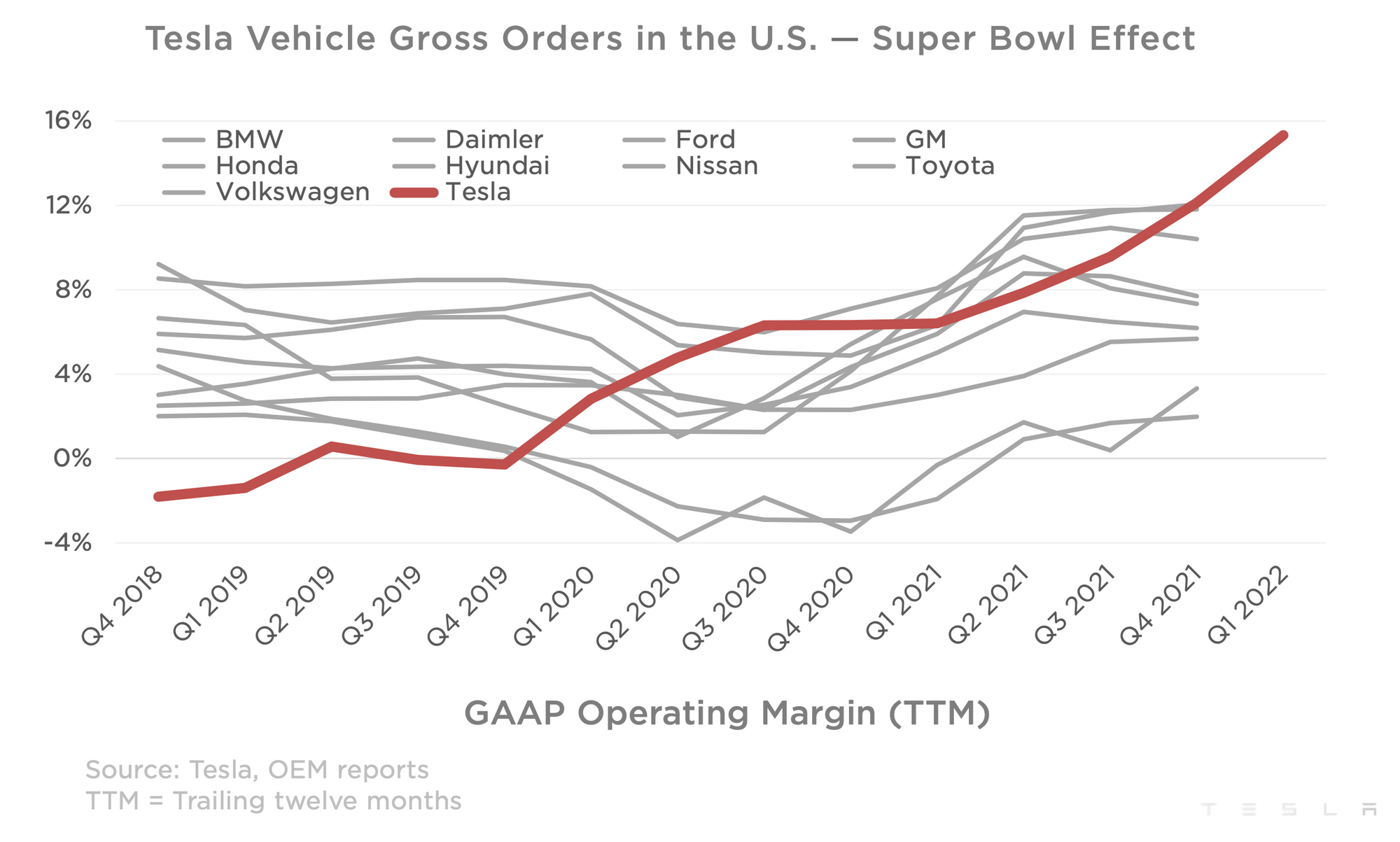

As a result of its vertical integration, Tesla currently enjoys the highest operating margins of any OEM. From Tesla’s Q1 2022 report:

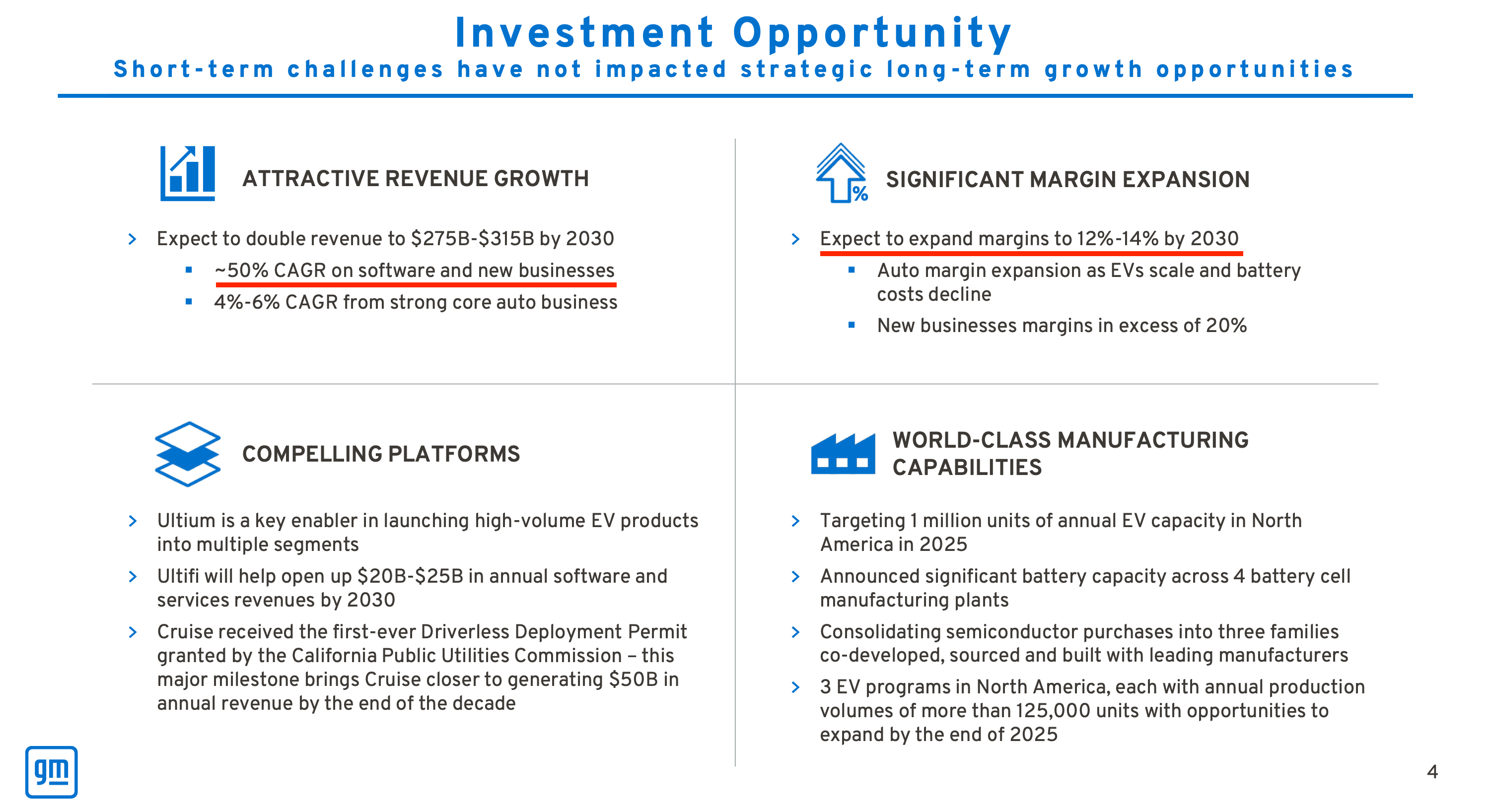

In addition to catalog engineering (“I'll get one of those machines, one of that machine, bingo, I'm now Tesla”), OEMs are also trying to convince investors that their businesses will be transformed into fast-growing, high-margin copies of Tesla. In its latest earnings report, GM forecast higher growth and higher margins:

Margins of 12-14 percent by 2030 are still below what Tesla achieved in early 2022, but 50 percent annual growth is—what a coincidence!—exactly what Tesla has promised.

Meanwhile, Volkswagen believes that by throwing money at the problem, it will become “the second largest software company in Europe only after SAP” according to recently ousted CEO Herbert Diess.

Diess organized VW’s software efforts into an autonomous unit called Cariad. Cariad has its own profit and loss statement, as it will provide services for all of VW’s disparate brands and in exchange receive revenues in the form of software license fees. It’s an incongruously modular approach for a company trying to become more integrated.

Thus far, Cariad isn’t working out for VW. For the EVs that Volkswagen has already produced, over-the-air updates required customers to visit dealerships to have them installed. Recently—in conjunction with Diess’s ouster—it was reported that setbacks in the Cariad unit are now responsible for multi-year delays among the various brands. Bentley, for instance, won’t be able to electrify until the end of the decade.

It is hard to think of examples of incumbent companies that have been successful in changing their cultures and developing the new musculature required to beat focused startups operating from an entirely new set of principles.

One wonders if VW’s vision of becoming the largest software company after SAP will resemble the software efforts of JP Morgan. For years, Jamie Dimon, JPM’s CEO, has touted the size of their developer workforce (click to see the full quote):

Jamie Dimon has been bragging for years that he has a bigger army of developers than Google. He’s obviously not getting his money’s worth! pic.twitter.com/0NAG5Nl1Cx

— Marcelo P. Lima (@MarceloPLima) January 15, 2022

By Dimon’s measure, JPM has been a larger software business than either Alphabet or Microsoft since at least 2014.

Citigroup is another example:

Citi has over 30,000 software engineers. Nuts. pic.twitter.com/aJ9IsRv0eL

— Marcelo P. Lima (@MarceloPLima) May 17, 2022

Despite their armies of developers, these banks still can’t match the agility and user experience offered by startups such as Square (now Block). Dimon acknowledged as much in 2019:

JPMorgan's Jamie Dimon did a commercial for @Square at the investor day yesterday: pic.twitter.com/iH0pDDSPus

— Marcelo P. Lima (@MarceloPLima) February 27, 2019

How successful will OEMs like Volkswagen be in catching up with Tesla's software prowess, particularly when they must navigate a thicket of obstacles like trade unions, family factions, and even the local government, which owns an equity stake in the company?

The latest frontier of vertical integration for Tesla is lithium refining. In all of Tesla’s earnings calls, Elon Musk has used the term “print money” twice.

The first was in 2019 when he explained that installing solar tiles in California is a no-brainer:

In California and in a number of other states, if you buy our sort of solar subscription or solar rental, there's no money down and you instantly save on your utility bill and there's no long-term contract. So it's kind of a no-brainer. It's really do you want something that prints money? And if it doesn't print money, we'll fix it or take it back. It's kind of a no-brainer. And it sort of plays into Tesla's overarching strategy here, which is effectively to become like a giant distributed global utility on the energy front.

The second time was this month when he talked about the margins available in lithium processing:

So lithium is actually a very common—sort of very—like lithium pretty much everywhere. But you have to refine the lithium into battery-grade lithium carbonate and lithium hydroxide, which has to be extremely high purity. So it is basically like minting money right now. There's like software margins in lithium processing right now. So I would really like to encourage, once again, entrepreneurs to enter the lithium refining business. You can't lose. It's a license to print money.

Elon has been taking his own advice. Two years ago Tesla got into lithium refining. It appears to be the single biggest chokepoint preventing Tesla from scaling its production capacity. Here’s Musk on the Q1 2022 earnings call:

I think we're seeing cases where the spot lithium price is 10x higher than the cost of extraction. […] Can more people please get into the lithium business? Do you like minting money? Well, the lithium business is for you.

[…]

There's limiting factors for accelerating the advent of a sustainable energy future. And whatever the most limiting factors are, Tesla will take action on those limiting factors. So right now, we think mining and refining lithium appears to be a limiting factor, and it certainly is responsible for quite a bit of cost growth in the cells.

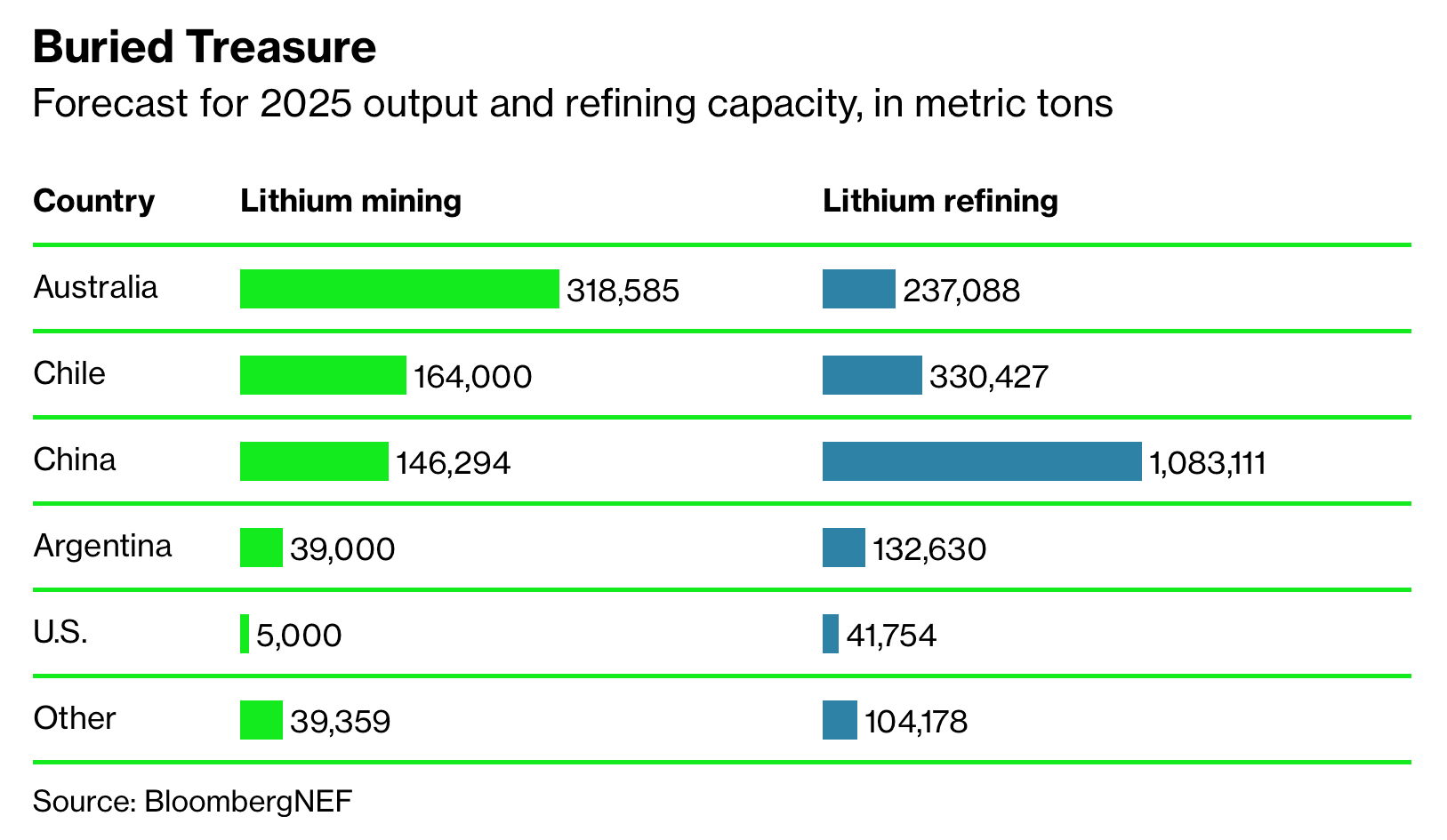

Currently, China dominates lithium refining capacity:

But Musk wants to change that. From Tesla’s Q2 2020 earnings call:

Vertical integration is extremely important for this. But the supply chain—if you put like a GPS tracker on a molecule from when it got mined to when it was in a usable product, it would look insane. It would be like, wow, it went around the world like six times. So with vertical integration, maybe you can only go around the world once. It would be a huge improvement.

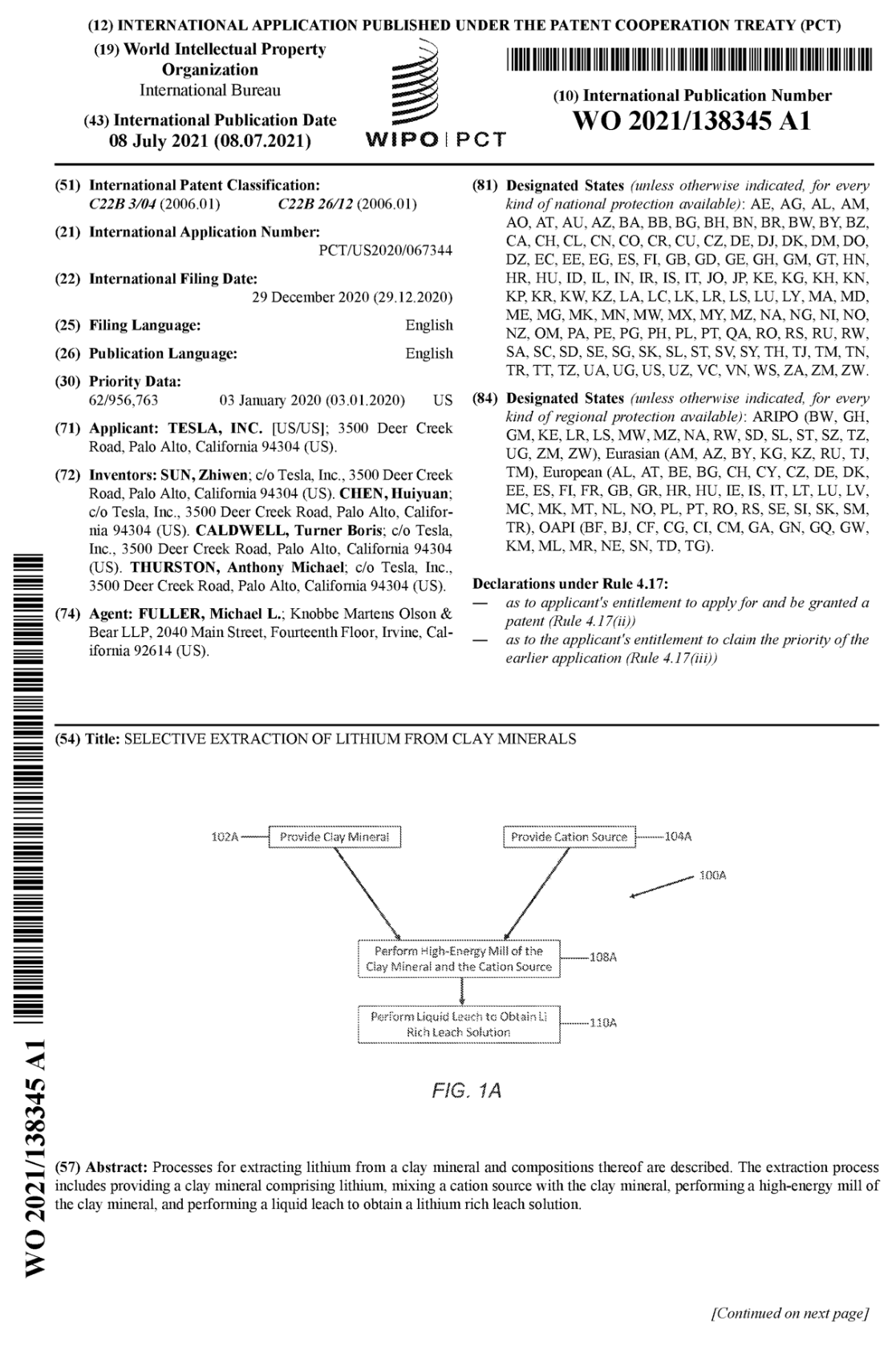

Rather than the molecule going around the world even once, Tesla wants to mine lithium in Nevada and refine it in Texas. It has even filed for a patent on a novel way of refining lithium using table salt rather than the current method of acid leaching:

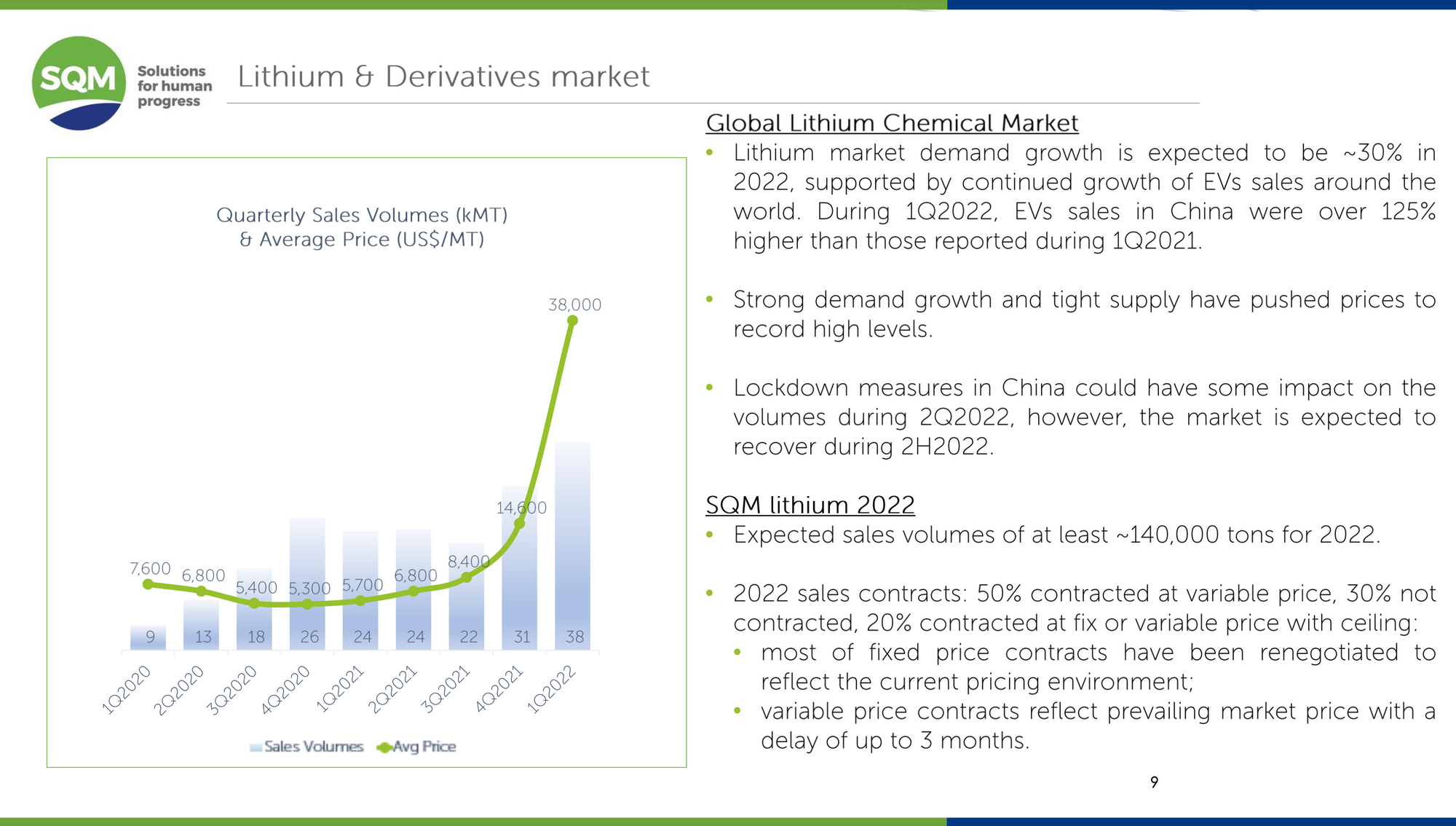

Lithium has been very profitable for miners. Here’s a recent slide from Sociedad Quimica y Minera de Chile showing average sales prices more than six times higher than the average of 2020:

Usually when there’s a big resource constraint driven by a secular trend, entrepreneurs will step in to provide financing and increase production. Many will recall the thesis of Leucadia National when, in 2006, it decided to finance an iron ore mine in Australia:

Prior to the emergence of China as a turbocharged economic growth engine commodity prices were pretty much in the doghouse during the latter part of the last century.

In our readings it came to our attention (and to many other investors, some sooner and smarter than we) that China is consuming an ever increasing amount of the world's resources. Some analysts and pundits think China is the country version of the old Pac-Man® video game and will devour the marginal production of all commodities, which will, for the foreseeable future, push up prices as China demands more and a greater share of the world's commodities.

It is also not surprising that China, an economy with 1.3 billion people who are beginning to discover the delights of a consumer society, wants and has the ability to consume more and more every year. Its demand for everything is likely to increase, both consumer goods and raw materials. In the meantime, as a low cost manufacturer of all the things that we no longer make here in the U.S.A., China has assembled an unspent cash hoard of over a trillion dollars and is busy spending part of this vast sum on soy beans from Argentina and Brazil, oil from the Middle East and iron ore and copper from Australia and other places.

China is also in the midst of building a new infrastructure, i.e., railroads, highways, factories, etc., all of which requires lots of copper, iron ore and energy. Prices for all of these commodities has risen dramatically over the last ten years, with copper going from $1.09 per pound to $3.00 per pound, Australian lump iron ore from $.37085 per dry metric tonne unit to $1.0264 per dry metric tonne unit and gas from $2.60 per mcf to $7.53 per mcf.

With our investments in copper, iron ore and oil and gas drilling, we are riding the wave of commodity price inflation and vicariously enjoying the roller coaster ride of China's booming economy. Certainly we can expect a bust one day, but we hope not too soon.

Soon after Leucadia’s investment in an equity stake in Fortescue Metals Group (as explained later in the same letter) as well as a royalty of four percent on its revenues, this happened to Fortescue’s stock:

In 2012, Leucadia finally exited the investment, having done its job and reaped its reward:

Our six year adventure with Andrew Forrest and FMG was rockier than the Aussie outback, but turned out to be the most financially rewarding. From start to finish Leucadia made $2.3 billion. It was a splendid outcome and we wish Andrew and FMG continued success.

Rewards this rich should entice entrepreneurs into lithium processing. The element is readily abundant and easy to extract—as Musk repeatedly points out. Refining, on the other hand, is another story.

Here, too, Musk would like others to step in and lower prices. But, as he concluded in the Q2 2022 earnings call, “If our suppliers don't solve these problems, then we will.” And if, in the process, Tesla discovers that it can create proprietary methods (such as its novel approach to refining), it will also get to keep the financial rewards of vertical integration, along with the benefit staying a step or more ahead of its modular competitors. Sooner or later, they too will discover that there is no catalog.