Tesla FSD Could Be Big

During Tesla’s second quarter earnings call last week, CEO Elon Musk said that Tesla is “very open to licensing our FSD software and hardware to other car companies.”

This isn’t the first time Musk has made this comment. Previously, I thought it was just his way of “playing nice” with incumbents. But this comment during an earnings call, next to an announcement that an auto OEM is interested in the partnership, meant he was serious.

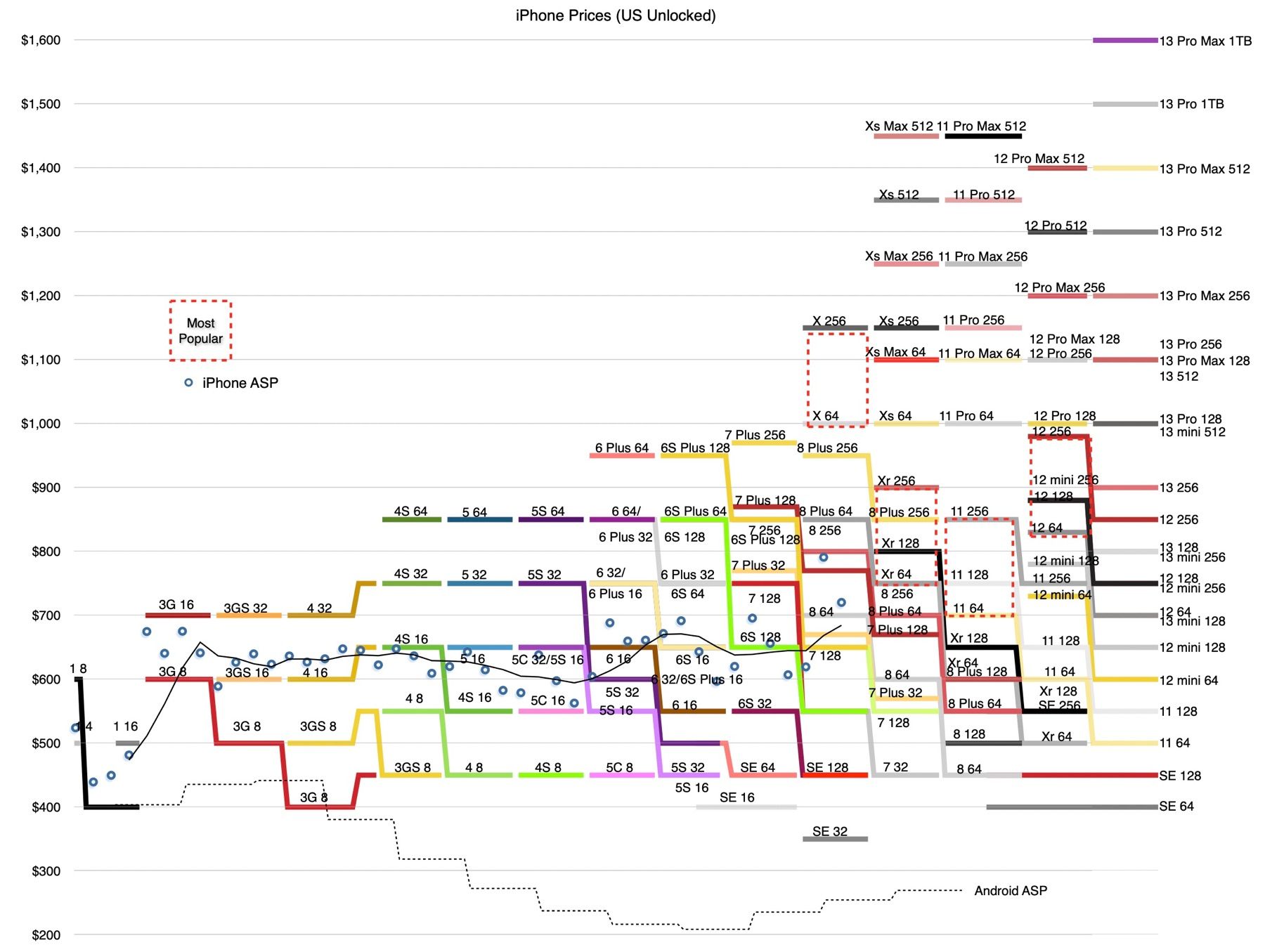

Initially, I thought this would be a terrible mistake. My mental model was Apple, a company that makes hardware differentiated by software. Over time, software has grown in importance as Apple layers on more services and software on top of the hardware. The iPhone is the company’s crown jewel, accounting for about 52 percent of the company’s revenues last year.

If Apple had licensed iOS, the iPhone operating system, the company would be a fraction of its current $3 trillion market cap. Licensing the operating system would mean that any other manufacturer could build competing hardware. Apple would have deprived itself of selling iPhones and of being able to tightly integrate hardware and software for a superior user experience.

When it comes to Tesla, however, this analogy is imperfect. Tesla is not building a new category of consumer electronic where it can fully supply the market. Apple’s iPhone sales are constrained not by capacity, but by the consumer’s willingness to spend substantially more for a phone compared to the alternative, Android.

Tesla’s sales, however, are capacity constrained. The company currently has an installed capacity of about 2 million vehicles.

Meanwhile, the global vehicle fleet is estimated at 1,300 million vehicles and is expected to grow to 2,000 million vehicles in 2030.

With a 20-year lifespan, new vehicle sales will therefore be around 100 million. Even if Tesla reaches its goal of 20 million new vehicle sales by 2030, it’s still only a 20 percent market share.

Meanwhile, Musk has stated—correctly in my view—that to truly win, Tesla must win at autonomy. If this doesn’t happen, then Tesla will simply be an automaker. If it wins in autonomy, however, it has to potential to be much more: an automaker and a supplier of the world’s leading operating system for autonomous transportation.

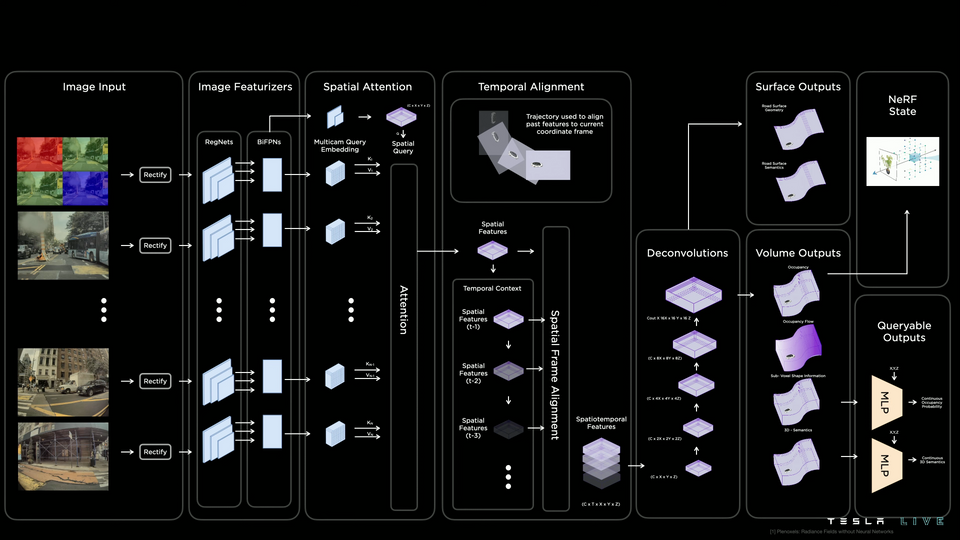

The main constraints on achieving full self-driving are compute and data. On the former, Tesla is buying all the Nvidia chips it can to expand its video processing capabilities, with which it trains its machine learning models. It’s also investing $1 billion in Dojo, a supercomputer using Tesla-designed custom silicon to supplant whatever Nvidia capacity it can’t get. On the latter, Tesla faces the fundamental constraint of how many cars it can build. Even though its vehicles have already driven 300 million miles in FSD beta, many more are needed to arrive at a point where FSD is 10x or 100x better than a human driver.

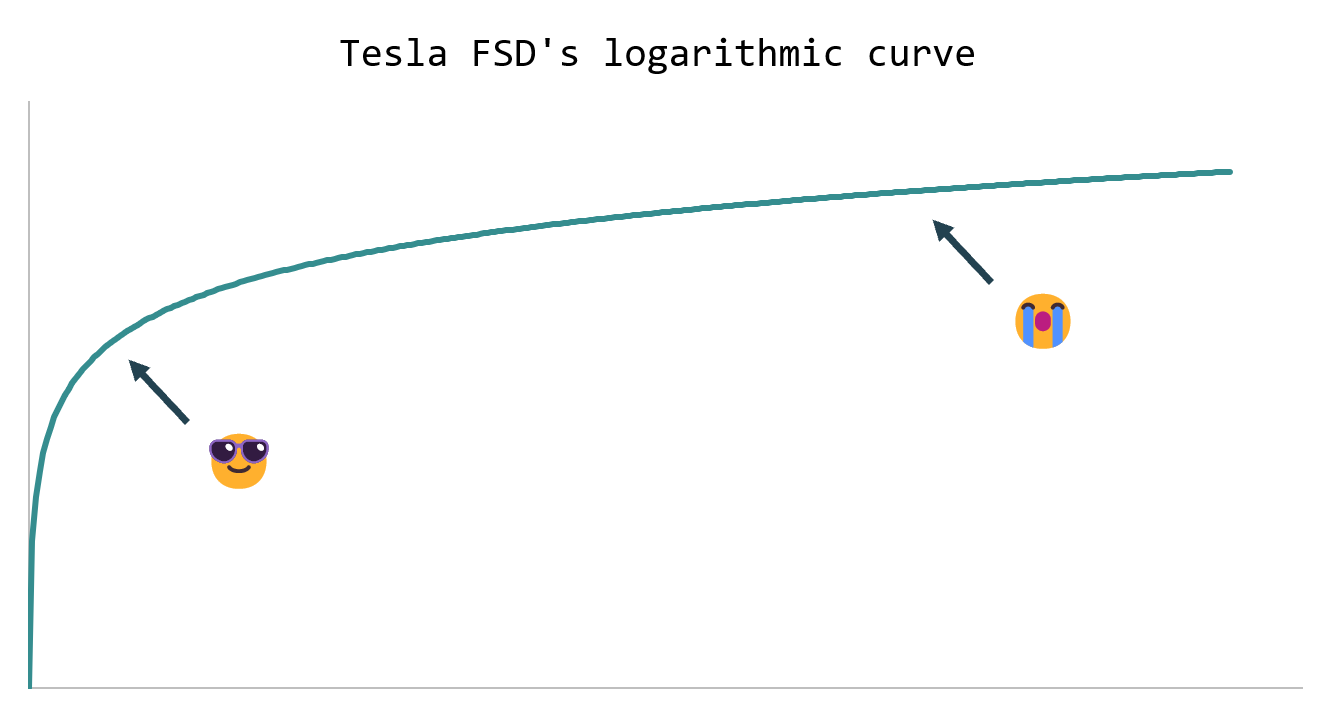

Musk admitted that his previous estimates for the arrival of FSD were off because progress is logarithmic. The curve looks promising at first but then progress tapers off. New solutions have to be engineered, and improvements therefore look like logarithmic curves stacked on top of each other.

The obvious solution to this scaling problem would be to license FSD hardware and software to competing automakers. If every new auto sold in the US adopted this idea, the potential FSD fleet would immediately grow eight-fold since there are about 16 million vehicles sold per year. Globally, the increase would be even greater.

This would solve the scaling problem, stack more logarithmic curves, and increase the probability of arriving at better-than-human FSD. It would also remove any incentive for the OEM to invest in its own homegrown FSD solution.

Jim Farley, CEO of Ford, admitted that the reason Ford adopted the Tesla NACS standard is because his company was too far behind in building out its competing Supercharger infrastructure. Since Ford adopted Tesla's Supercharging network, several other OEMs have followed suit.

Building out charging stations is a lot easier and cheaper than developing FSD. Very few OEMs, such as General Motors with its Cruise subsidiary, even have a horse in this race. It would be reasonable to expect that when Tesla’s first FSD OEM partner makes its announcement, that others will follow. Eventually, since FSD scales with fleet data and compute, it would not be unreasonable to imagine that Tesla could garner a significant market share in the FSD market.

Competing Solutions

The two main competitors of Tesla FSD in the US are Cruise, owned by General Motors, and Waymo, owned by Alphabet, Google’s parent company. Both rely on LIDAR and other sensors, in addition to cameras, for their autonomy solutions.

Both also rely on HD maps to navigate. These maps must be constantly updated. Tesla, on the other hand, relies only on camera sensors. The robustness and scalability of solutions that rely on more sensors and HD maps is debatable. So far, Cruise’s and Waymo’s fleets are geofenced in Arizona and California, and only have a few thousand vehicles deployed.

One big challenge for Waymo and Cruise is that it costs them an enormous amount of money to scale their fleets and acquire training data. They must acquire the vehicles, install the costly sensors, and acquire customers for ride hailing. The more they grow, the more working capital is needed for the upfront investment.

Tesla, on the other hand, gets paid to grow its fleet and acquire training data, since customers buy its vehicles. Tesla can use the profits from its automotive sales—nearly $20 billion in gross profits in the last twelve months—to reinvest in improving FSD. Scaling is therefore a tougher proposition for Waymo and Cruise given that they’re losing an estimated $1 billion each and require additional capital to grow.

Mobileye

Mobileye is the dark horse in this race. The company, acquired by Intel and recently spun out, is a pure play solution for incumbent OEMs. It’s a nascent solution that also uses LIDAR, cameras, and HD maps. It boasts Volkswagen as a partner. It’s impossible to know how good the solution is: while there are endless videos of Tesla FSD customers’ drives on YouTube, the only ones of Mobileye are short videos produced by the company itself. Mobileye is also losing money.

How Big Could FSD Be?

Tesla, therefore, seems to be far and away the best-positioned player to achieve autonomy. It has the largest fleet and the most data. CEO Elon Musk estimates that Tesla has a data advantage of at least an order of magnitude more than all its competitors combined, and it’s investing heavily in the compute required to further advance its training and inference models.

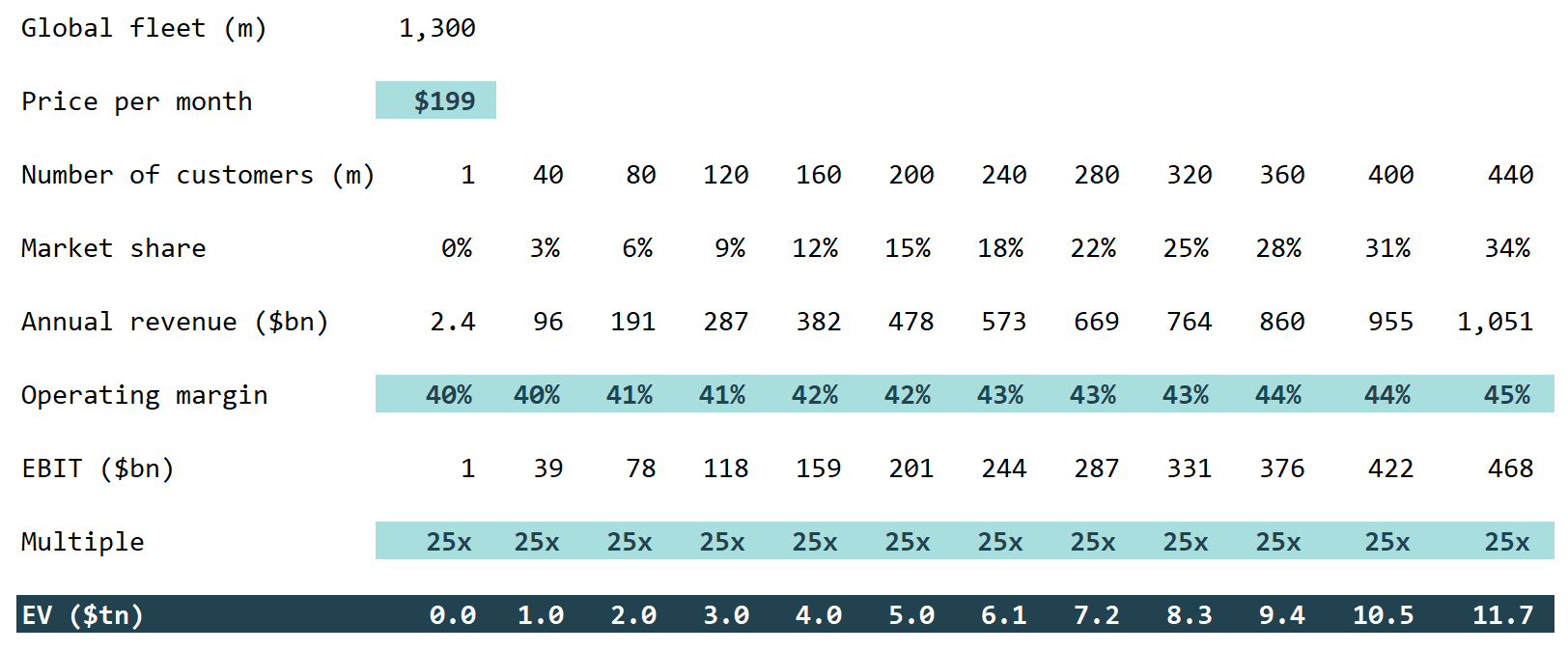

Currently, FSD is sold to Tesla customers for a one-time fee of $15,000 or a monthly subscription of $199. Most customers pay the one-time fee, but over time it makes more sense to sell subscriptions, since the software-as-a-service business model better aligns incentives: customers pay for continued usage, and the company has an incentive to keep improving the software to prevent churn.

Let’s make some basic assumptions for a moment just to frame how big the FSD licensing opportunity could be for Tesla. These are just assumptions: we don’t know if Tesla will charge a licensing fee for its hardware or software, whether it will share FSD revenues with other OEMs, and on what terms.

We also don’t know how the price will change in the future, and how price will be discriminated between fleet owners and individuals. There might also be usage-based pricing: pay one low fee if you only drive 12,000 miles per year, and a higher one for more extensive usage.

Finally, Tesla has repeatedly talked about creating its own robotaxi network, where it would share in the revenues earned by owners. The assumptions below do not take that into consideration.

Imagine, very simply, that FSD will be sold for $199 per month. Below we assume the global vehicle fleet is around 1.3 billion vehicles today, that this software will eventually generate pre-tax (EBIT) margins of around 40-45 percent (in line with SaaS companies like Adobe), and garner a multiple of 25x pre-tax profits. The numbers get very large very quickly.

Tesla has an enterprise value of around $830 billion (the stock price is at $268). With just 40 million FSD customers, or a 3 percent market share, FSD alone would be worth more than the entire company is worth today. At a 30 percent market share, FSD would be worth $10 trillion.

Google is a natural monopoly in search because it started early with a superior algorithm (PageRank) and ran away with a prize in a field littered with incumbents. Over time its advantages snowballed given its superior business model, algorithm, data, and compute.

As a result, it has become a natural monopoly with an estimated 90 percent market share in search queries globally. If something similar happens with FSD software, Tesla would indeed have the opportunity to build a company whose value the world has not yet seen.