Okta’s Execution Mess

Okta, the cloud identity provider, reported earnings this week and while the results were very strong on the surface, the company flagged extensive challenges integrating its Auth0 acquisition, sending the stock down over 30 percent and wiping $4.7 billion in shareholder value.

The company was co-founded by Todd McKinnon and Frederic Kerrest in 2009. McKinnon had worked at Salesforce for several years and saw the opportunity to create a pure-play in cloud identity management. So he created PowerPoint slides to convince his wife it was a good idea.

And it was: Okta raised venture capital, went public, and this year is expected to bring $1.8 billion in revenue, 39 percent growth from the previous year.

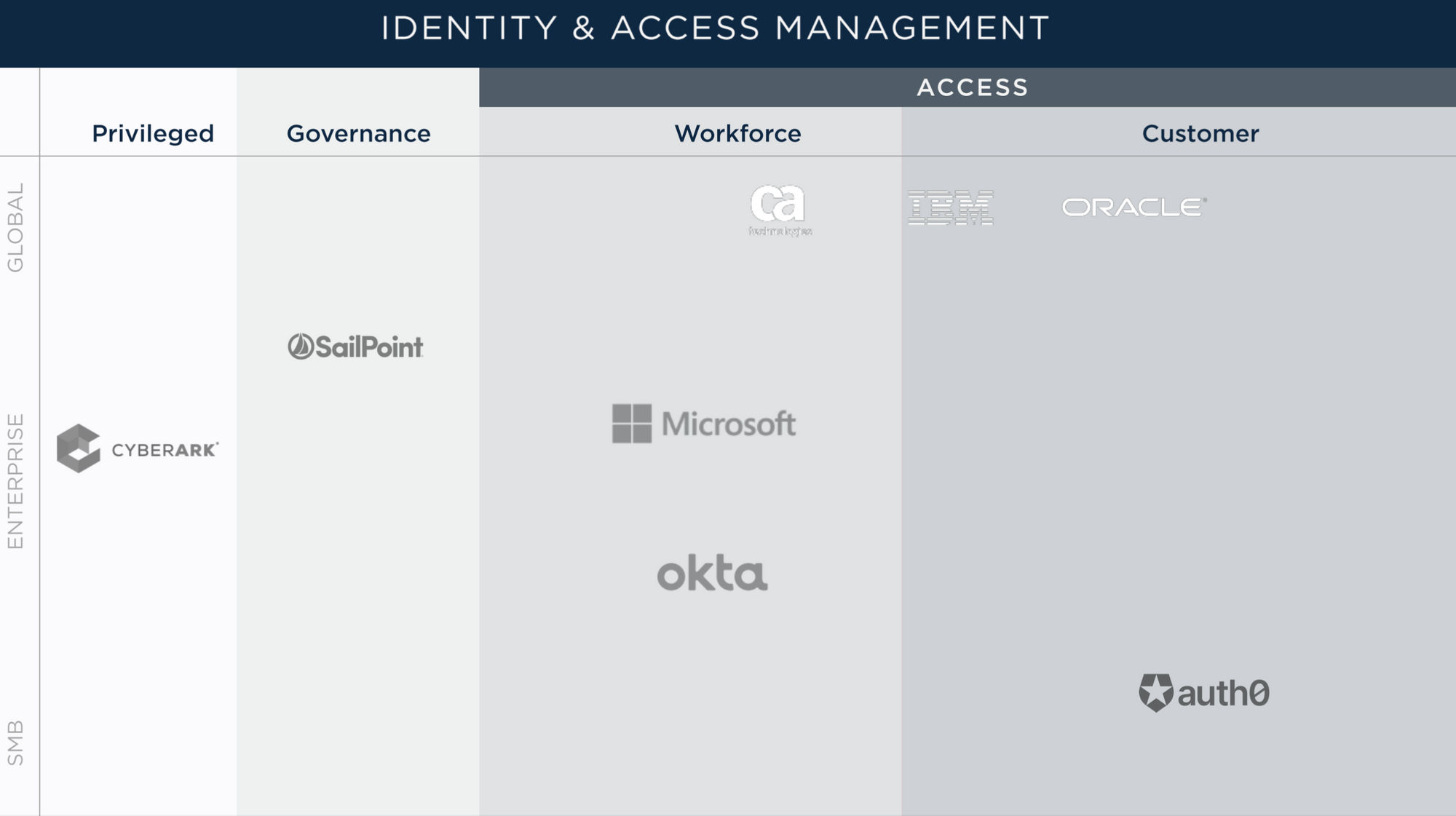

Okta competes with Microsoft, which bundles its identity product with its other offerings, and legacy solutions like SailPoint and Ping, both of which were recently acquired by Thoma Bravo. It is building products to compete against CyberArk as well in the Privileged Access Management space. In short, those companies have a history of being on-premises and are building cloud solutions; Okta is cloud-first and will be adopted by modern enterprises.

This chart is a simplified view of the identity and access management industry, and which companies compete in each lane:

Auth0 Acquisition

Okta is sold top-down by quota-carrying sales reps, and had no strength in Customer Access Management. To fill that gap, it acquired Auth0 in March 2021 in a stock deal valued at $6.5 billion. Auth0 is sold mostly bottom-up and adopted by developers through trials. The company was on pace to generate $200m in ARR so the deal was richly valued at 32.5x despite Auth0’s reported 50 percent yearly growth.

Okta was beginning to attempt to replicate the Salesforce playbook of acquiring SaaS companies and plugging them into its distribution, while consolidating sales and R&D.

But if you want to replicate Salesforce’s success, you must execute like Salesforce. Okta’s execution, on the other hand, has been severely lacking.

Sales Disintegration

In February of this year during Okta’s Las Vegas company kickoff—a type of event many software companies host to fire up their sales teams—Eugenio Pace, Auth0’s co-founder, used a tandem bicycle to make the point that Okta and Auth0 are now one company working together:

On the August 31st earnings call, however, management admitted this vision was still far from becoming a reality. McKinnon noted:

Individually, Okta and Auth0 were leading identity providers. Together, we offer the most comprehensive identity platform in the market that is unmatched competitively and creates powerful long-term network effects for us and for our customers. Organizations around the globe are looking for scalable and secure ways to digitally interact with our customers. Together with Auth0, we win the customer identity market faster and accelerate our vision of establishing Okta as a primary cloud.

Integrations are always difficult and touch every part of an organization. While we are making progress, we've experienced heightened attrition within the go-to-market organization as well as some confusion in the field, both of which have impacted our business momentum. In order to improve our performance going forward, we've implemented a number of action items. For starters, we're committed to stem attrition within our go-to-market team. This is a top priority for me and my staff, and we're in lockstep on actions to take. This includes making changes to our organizational structure to better align on our strategy, increased sales training and enablement and also improving the comp structure for the go-to-market team to ensure they feel set up for success.

The second action we've taken is to improve our go-to-market effectiveness. Earlier this month, we unified the pricing, quoting and opportunity management system. This is a big deal because the sales team is now working from a single integrated CRM system, which wasn't the case previously.

I am not by any means an expert in integrating sales forces, but a couple of admissions here seem shocking, to say the least. First, McKinnon is saying that many salespeople left the company because they didn’t buy into the idea of selling both Okta and Auth0 and that additional training would be needed, Eugenio Pace’s tandem bike analogy notwithstanding.

However, Okta closed on the Auth0 acquisition in May 2021. That it has taken 16 months to come to this realization is incredible. Secondly, and perhaps more alarming, is the fact that until earlier in August of this year these sales teams didn’t even have a unified Rolodex (CRM system) to call on prospective customers.

Later in the call, McKinnon explained that integrating Okta’s and Auth0’s sales forces only happened after three quarters of parallel execution, and while he admitted that these challenges lay “squarely on my shoulders” he did call out the head of field operations Susan St. Ledger and Chief Revenue Officer Steve Rowland.

What have they’ve been doing if not unifying the CRM system and training sales reps?

We know one thing they’ve been doing: selling stock.

Cockroaches in the Kitchen

Warren Buffett is a long-time bank investor and was a fan of Wells Fargo for decades. In 2017, he contrasted its management team with Bank of America’s. Wells Fargo had long had management problems, and its string of negative announcements hasn’t ended.

Buffett noted in an interview about Wells Fargo that “What you find is there’s never just one cockroach in the kitchen.” That’s because these problems seem to be interwoven with a company’s culture and the incentives baked into that culture. In Wells Fargo’s case, the root cause seems to have been incentives to cross- and up-sell its customers, resulting in a lot of fraud over the years.

In hindsight, Okta seems to have had several cockroaches in its kitchen, too.

For instance, in December 2020 Okta’s longstanding CFO Bill Losch retired, and Okta replaced him with Mike Kourey, who had been on Okta’s board for the previous five years. Three months later, Kourey liquidated $4.4 million worth of Okta stock, and two months after that, Kourey and McKinnon “mutually decided it wasn’t a fit” which is code for “what was I thinking.”

McKinnon had worked with Kourey for five years, touted him as a great fit, only to decide a few months later that wasn’t the case. A search was initiated for a replacement, but Okta seems to have settled on Brett Tighe, erstwhile interim CFO, as permanent CFO.

Then, in early 2022, a subcontractor of Okta’s suffered a security breach. Okta’s response was confused and unclear, fumbling while the stock declined by over 45 percent. Ben Thompson of Stratechery, interviewing McKinnon in June, summarized it well with this question:

I’m interested in the fullness of time bit, because my second “What happened?” question is a bit more meta and it’s not about January at all, it’s about March. Suddenly these Okta screenshots pop up on Lapsus$ Telegram channel and on March 22nd, you come out with a blog post saying, “Yeah, something happened in January. We don’t think it’s a big deal.” The blog post says, and I’m quoting, “The Okta service has not been breached and remains fully operational.”

Later that day, Okta comes out with a new blog post that says, “The attacker accessed an engineer’s laptop for five days. And we have concluded that a small percentage of customers, approximately 2.5% have potentially been impacted whose data may have been viewed or acted upon. We have reached out by email.” It seems a little more important than to get a random email, but then the next day Okta said the “The maximum potential impact of the security breach was 366 customers.” A month later, Okta comes back and says, “The systems were breached for 25 minutes. And two customers were impacted.”

We’re getting the full story of time here, but walk me through those, what was going on, on March 22nd and March 23rd? Because the story we were getting from Okta was 1) different than the story you just told, but 2) was also a bunch of different stories within a very short amount of time.

Now, McKinnon is telling us that 16 months after acquiring Auth0 they hadn’t bothered to properly train their sales reps or integrate the CRM systems. It begs the question: what other cockroaches are there in Okta’s kitchen?

Spending and Free Cash Flows

Great CFOs are extremely rare, and great CFOs at specialty businesses like fast-growing SaaS companies seem to be rarer still. We can only judge the tenure of Brett Tighe by the results so far, and they are not encouraging.

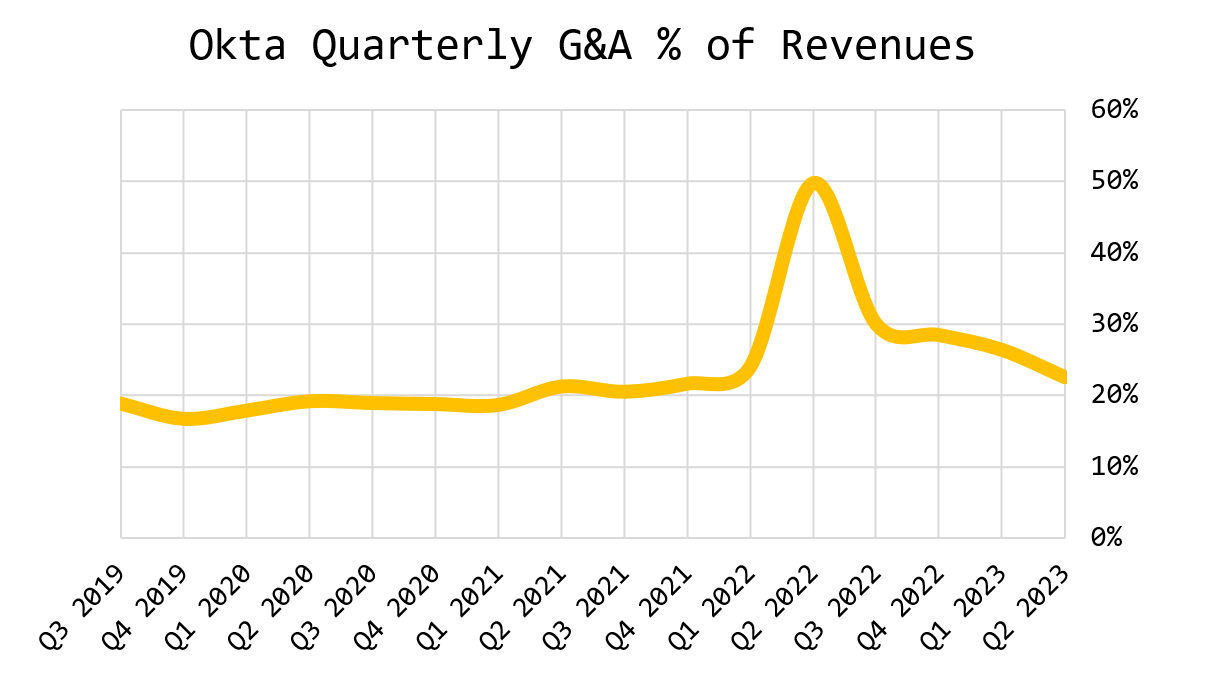

For instance, Okta is spending more on “General and Administrative” as a percentage of revenue now that it’s generated $1.6 billion of trailing twelve month revenue than when it had only $400 million. Where are the back-office efficiencies and operating leverage? This is precisely what a CFO is for:

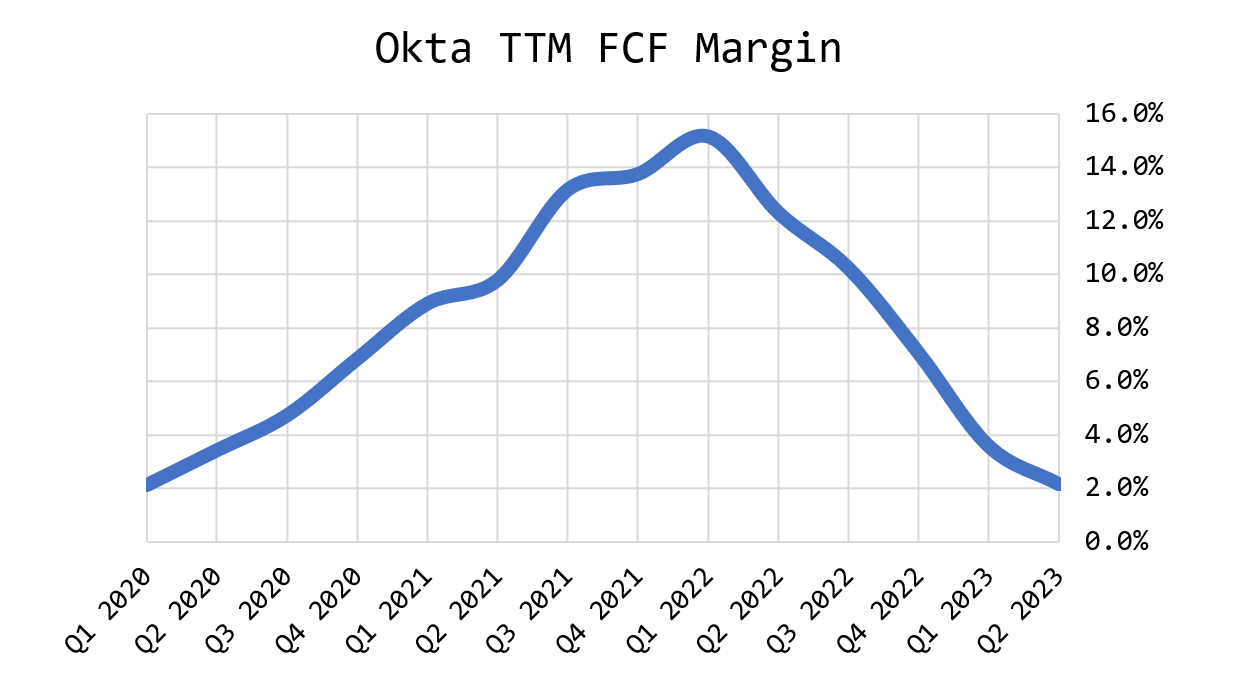

This is symptomatic of excessive spending at the company; so excessive that Okta’s free cash flows are 2 percent of revenues compared to 15 percent a year ago, despite revenues growing 77 percent:

Pulled Guidance

Every business ultimately trades on a multiple of earnings or free cash flows. In the case of SaaS businesses it’s typically the latter given the prevalence of stock-based compensation.

Stock-based compensation at Okta, however, is truly off the charts. While Salesforce’s SBC has been around 46 percent of reported free cash flows (on average), Okta’s have been 550% since early 2020.

No amount of growth can overcome the incredible amount of stock dilution that Okta foists upon its shareholders every year, with growth in share count averaging over 11 percent per year, also since early 2020.

Part of the job of a CFO is to control these variables and make sure they are sustainable; and part of the job is also to manage investor expectations, which is why Okta’s fiscal year 2026 guidance was so important.

In the absence of free cash flows or earnings as a way to value the company, Okta had provided a useful guidepost: $4 billion of revenues by 2026 and a 20 percent free cash flow margin.

Assuming 3 percent yearly stock dilution—a big assumption—if Okta did indeed generate $4 billion of top line in fiscal 2026 with 20 percent free cash flow margins, that would be about $4.66 in free cash flow per share, valuing the company at 14x that figure with the current stock price of $65.

But Okta pulled that guidance and left investors in a vacuum. CFO Brett Tighe said on the earnings call:

Given our near-term outlook, coupled with the uncertainties of the evolving macro environment, we are reevaluating our FY '26 targets at this time. Having said that, we will continue to balance growth and profitability, and we look forward to updating you on our long-term outlook on the Q3 earnings call.

This is as un-candid a statement as one could wish for. Okta flagged “some tightening of IT budgets and lengthening sales cycles relative to last quarter. This leads us to believe that the weakening economy is having some impact on our business” however it later admitted that over half of the weakened outlook was from the sales integration issues, another piece was from increased attrition, and only a small part due to macro concerns.

There also seems to be little “balance” of “growth and profitability” at Okta; it appears to be growth at all costs, and growth with mismanaged costs, given that expenses like G&A should be decreasing with growth in revenues, but are instead moving in the opposite direction.

Okta stock is now languishing at 5x revenues, a fraction of the multiple that Thoma Bravo agreed to pay for its smaller and slower-growing competitor SailPoint earlier this year. Given the serial missteps, the discount seems warranted. The question for Okta investors now is whether this culture can be fixed, or whether it’ll be a perpetual series of blunders like Wells Fargo.