Unity: Doesn’t Add Up

This is a follow-up to yesterday’s post on the Unity/ironSource merger announcement.

The most two most salient points I’d like to examine today are the 2024 EBITDA guidance Unity provided and Unity’s leadership. Let’s take a closer look at both.

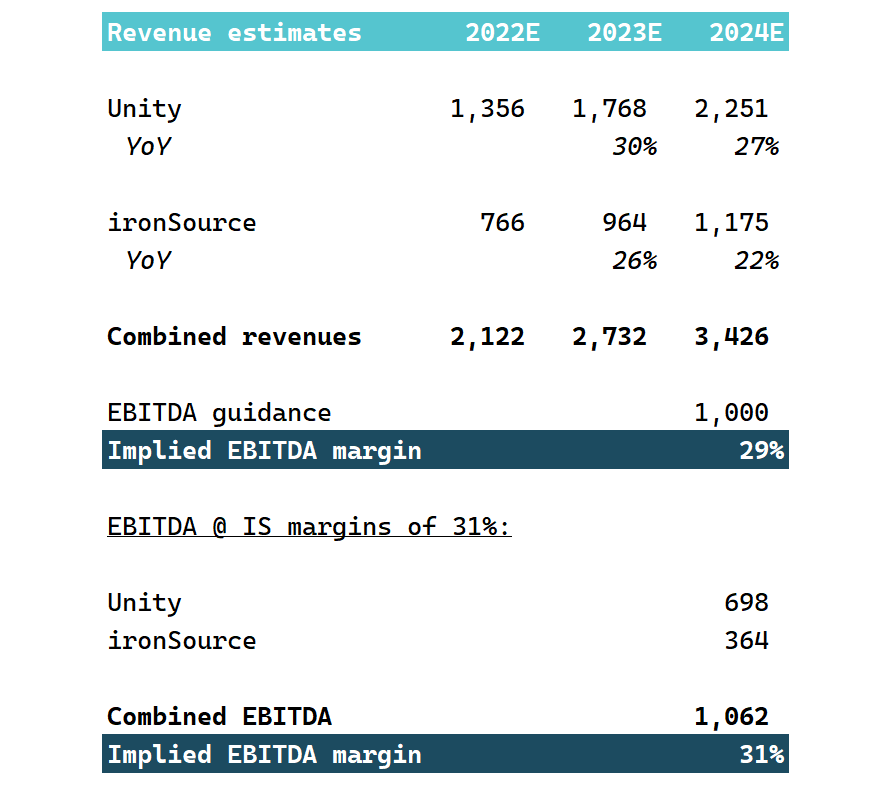

Below are revenue estimates for Unity and ironSource, from Bloomberg sell-side estimates, as of this morning. Revenue and EBITDA numbers are in millions of dollars:

We can see that the combined companies are expected to post $3.4 billion of revenue in 2024. (The difference from the $3.2 billion in yesterday’s post stems from using my internal model rather than Bloomberg estimates, but in any case, the delta is only ~6 percent.)

Recall that Unity’s current operating margins are running at -7 percent, and that in in February Unity’s CFO Luis Felipe Visoso said he expected to breakeven by 2023: