Twilio’s Margin Target: How Achievable is It?

Twilio reported Q2 earnings on August 5th and despite delivering on its promise of organic growth of at least 30 percent—it reported 33 percent organic revenue growth in the quarter—the stock declined 18 percent the following day.

From Bloomberg:

Twilio Inc. shares fell the most in more than nine months on Friday after the maker of customer communication and marketing software gave a forecast for the current quarter that fell just short of estimates, signaling concerns that companies may pull back spending for business tools amid an uncertain economy.

Revenue will increase about 31% to $970 million in the period ending in September, the company said Thursday in a statement. Analysts, on average, estimated $975.6 million. Twilio projected a loss, excluding some items, of as much as 43 cents a share, compared with analysts’ estimate of a loss of 11 cents, according to data compiled by Bloomberg.

“We have not seen broad-based impacts to our business yet because of the macro economy,” Chief Executive Officer Jeff Lawson said in an interview. “We’re preparing ourselves for a variety of outcomes that could come, but we are cautiously optimistic.”

The narrative was that the stock declined because of the cautious outlook, but I think it was something else altogether: the continued decline in Twilio’s gross margins, which makes its margin targets less achievable.

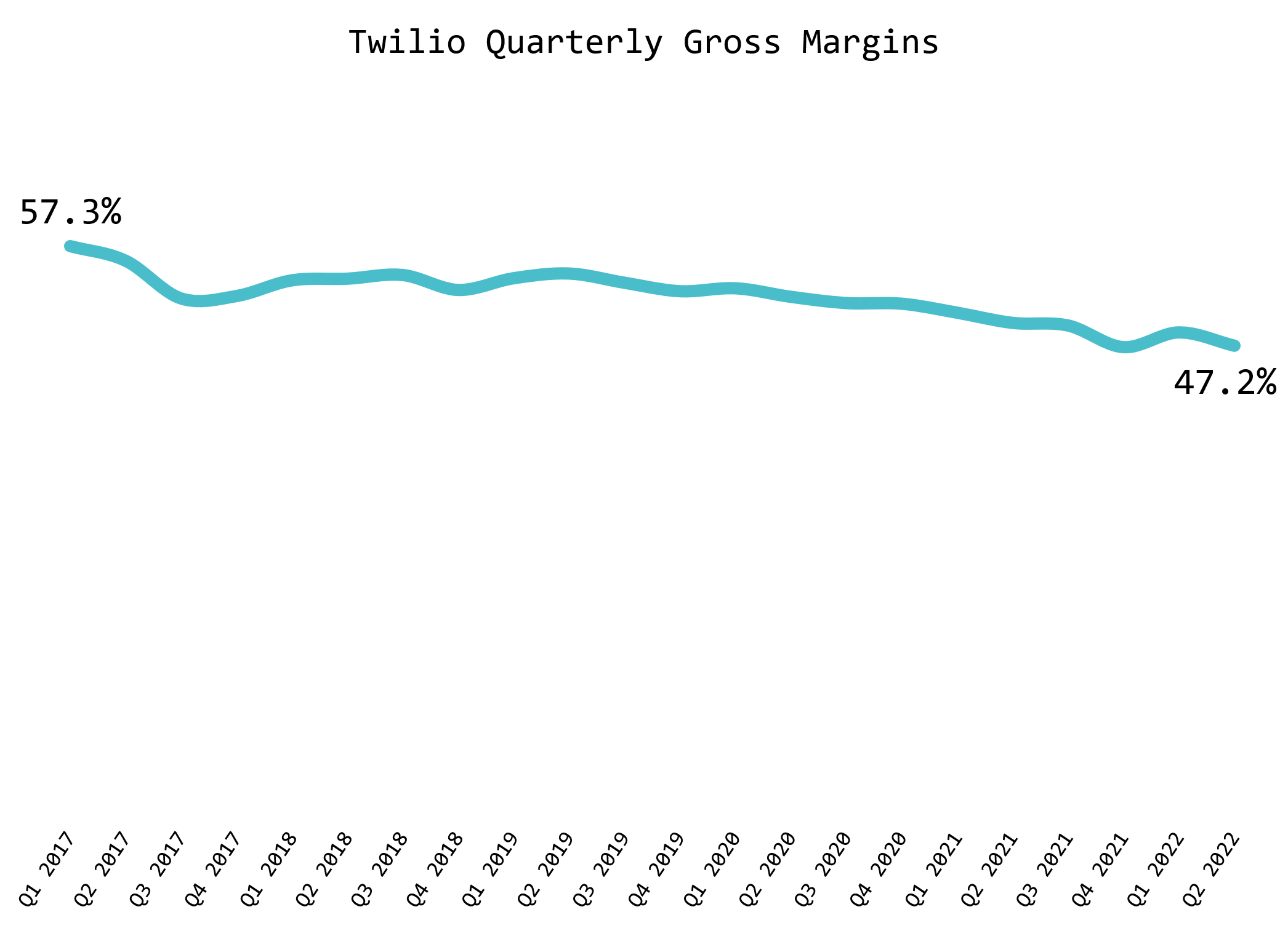

As outlined last month, Twilio’s gross margins have declined from 57 percent in early 2017 to 49 percent in the first quarter of 2022. Second quarter gross margins declined yet again to 47.2 percent.

Declining gross margins aren’t a bad thing—what should matter for a business are gross profit dollars and how they are being reinvested.

In Twilio’s case, declining gross margins mean that its core messaging business is going gangbusters: this business has lower gross margins than Twilio’s SaaS-like businesses. Not only that, but the messaging business has been impacted by two more factors: competition and international mix.

On competition, MessageBird, Sinch, Bandwidth and others offer functionality that is “good enough”. This has inevitably resulted in margin pressure for Twilio’s messaging offerings.

Twilio’s international mix has also increased, and international messaging business is lower margin than Twilio’s domestic business.

Moving Up the Stack

Twilio’s strategy has long been to harvest the gross profits from that core usage-based business and reinvest into developing applications higher up the stack, such as Flex, as well as acquiring SaaS businesses such as SendGrid. These products command much higher gross margins, and over time, they would allow Twilio to increase its overall company gross margins.

This strategy has been successful and Twilio’s mix of revenues has gone in the right direction. In 2018, for instance, 84 percent of Twilio’s revenues were from usage-based fees (for instance, fees for number of text messages sent). The remaining 16 percent came from fee-based, SaaS-like products such as Twilio’s Email API (through the SendGrid acquisition), Marketing Campaigns, Flex seats (its internally developed digital contact center), telephone numbers, short codes and customer support.

By early 2019, Twilio’s usage-based revenues had dropped from 84 percent to 76 percent of total revenues with the addition of SendGrid.

Since then, though, Twilio’s usage-based revenues have remained stubbornly high as a percentage of overall revenues, at 73 percent in the most recent quarter, despite the acquisition of Segment and continued growth in Flex.

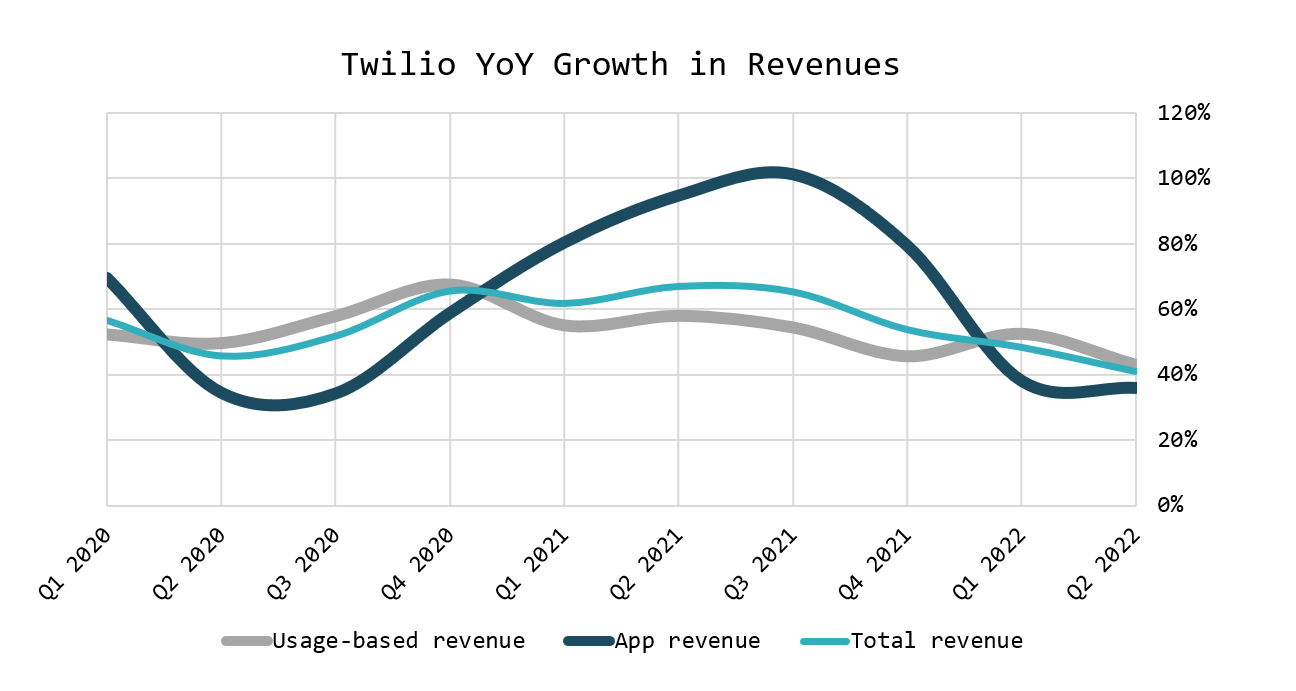

For all the growth in Twilio’s SaaS businesses, messaging has grown even faster:

Note how the messaging, or usage-based revenue line, has been above the SaaS (app revenue) line.

The exception is the bump in 2021, particularly Q3 2021. However, that period benefited from the inclusion of recently acquired Segment, which added $52.3 million of app revenue in Q3.

To be clear, app revenue wasn’t growing at over 100 percent in Q3 2021; Twilio’s app revenue appeared to grow that much because of the inclusion of Segment, but the underlying growth of the app revenue businesses is much lower. If we exclude Segment’s $52.3m contribution from Q3, app revenue growth would have come in slightly below usage-based revenue growth.

In Q1 and Q2 of this year, without the benefit of more acquisitions of SaaS businesses, Twilio’s usage-based revenues again grew faster than app revenue. Here we have a clearer picture of the underlying, organic growth of app revenue business. It’s growing strongly, but not strongly enough to make a dent on the revenue mix.

Specifically, in Q2 usage-based revenue growth was 43 percent and app-based revenue growth was 36 percent.

Why This Matters

There is only one reason why any of this matters: Twilio is not profitable. It has yet to generate positive free cash flows, and has posted operating margins consistently around -30 percent every quarter (-8 percent if we add back stock-based compensation).

And yet, Twilio has promised that it will eventually generate +20 percent operating margins (after adding back SBC) and gross margins of 60-65 percent. One cannot happen without the other: Twilio will not be able to achieve the promised 20 percent operating margin on its current 47 percent gross margin.

While Twilio’s gross margins have only moved in one direction—down—Twilio is sticking to the gross margin target. In the most recent quarter, CFO Khozema Shipchandler reaffirmed that “we still feel good about our 60% plus gross margin target longer term.”

The question we are trying to answer is: how fast does Twilio’s higher margin app-based revenue have to grow in order to achieve Khozema’s promised 60 percent gross margin in a reasonable time, say in five years?

Let’s do the math on what would have to happen for Twilio to get there. There is a lot going on in the chart below, but we’ll go through it step-by-step. Since the year is almost over, we’ll project this through 2028: